Analysis#

Importing Libraries and Dataset#

import pandas as pd

# from ydata_profiling import ProfileReport

from statsmodels.tsa.seasonal import STL, MSTL

import matplotlib.pyplot as plt

import seaborn as sns

import numpy as np

from statsmodels.graphics.tsaplots import plot_acf, plot_pacf

import statsmodels.api as sm

import warnings

import random

from sklearn.linear_model import LinearRegression

Show code cell source

from IPython.display import display, HTML

def displayHorizontalDataframes(dfs, titles):

"""

Display a list of pandas dataframes horizontally with titles on top.

Parameters:

dfs (list): List of pandas DataFrames.

titles (list): List of titles (strings) corresponding to each DataFrame.

"""

if len(dfs) != len(titles):

raise ValueError("The number of dataframes and titles must be the same.")

# Start a flex container to align content horizontally and center them.

html = (

"<div style='display: flex; justify-content: center; "

"align-items: flex-start;'>"

)

# Iterate over the dataframes and their corresponding titles.

for df, title in zip(dfs, titles):

html += (

"<div style='margin-left: 20px; margin-right: 20px; text-align: center;'>"

f"<h3>{title}</h3>"

f"{df.to_html(classes='dataframe', border=1)}"

"</div>"

)

html += "</div>"

display(HTML(html))

def custom_repr_html(self):

# Apply a custom style that sets the font size for <td> and <th> elements.

return self.style.set_table_styles(

[{'selector': 'td, th', 'props': [('font-size', '12.5px')]}]

)._repr_html_()

# Override the default _repr_html_ method for all DataFrames.

pd.DataFrame._repr_html_ = custom_repr_html

df = pd.read_csv('../../Stationary/Data/walmart.csv')

Preliminary Data Cleaning#

df.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 6435 entries, 0 to 6434

Data columns (total 8 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 Store 6435 non-null int64

1 Date 6435 non-null object

2 Weekly_Sales 6435 non-null float64

3 Holiday_Flag 6435 non-null int64

4 Temperature 6435 non-null float64

5 Fuel_Price 6435 non-null float64

6 CPI 6435 non-null float64

7 Unemployment 6435 non-null float64

dtypes: float64(5), int64(2), object(1)

memory usage: 402.3+ KB

df.set_index(['Date', 'Store']).head(3)

| Weekly_Sales | Holiday_Flag | Temperature | Fuel_Price | CPI | Unemployment | ||

|---|---|---|---|---|---|---|---|

| Date | Store | ||||||

| 05-02-2010 | 1 | 1643690.900000 | 0 | 42.310000 | 2.572000 | 211.096358 | 8.106000 |

| 12-02-2010 | 1 | 1641957.440000 | 1 | 38.510000 | 2.548000 | 211.242170 | 8.106000 |

| 19-02-2010 | 1 | 1611968.170000 | 0 | 39.930000 | 2.514000 | 211.289143 | 8.106000 |

df.set_index(['Date', 'Store']).tail(3)

| Weekly_Sales | Holiday_Flag | Temperature | Fuel_Price | CPI | Unemployment | ||

|---|---|---|---|---|---|---|---|

| Date | Store | ||||||

| 12-10-2012 | 45 | 734464.360000 | 0 | 54.470000 | 4.000000 | 192.327265 | 8.667000 |

| 19-10-2012 | 45 | 718125.530000 | 0 | 56.470000 | 3.969000 | 192.330854 | 8.667000 |

| 26-10-2012 | 45 | 760281.430000 | 0 | 58.850000 | 3.882000 | 192.308899 | 8.667000 |

def cleaning(df_copy: pd.DataFrame) -> pd.DataFrame:

df = df_copy.copy(deep=True)

df['Date'] = pd.to_datetime(df['Date'], format=r"%d-%m-%Y")

df['Store'] = df['Store'].astype(pd.StringDtype()).astype('category')

df['Holiday_Flag'] = df['Holiday_Flag'].astype(pd.BooleanDtype())

df = df.rename(columns={col: col.lower() for col in df.columns})

return df

df = cleaning(df)

Final/Major Observations#

Final/Major Observations

Data Overview

Dataset Scope

The data covers weekly sales for 45 unique stores over 143 weeks (from February 5, 2010, to October 26, 2012).

There are no missing values in the dataset.

Feature Specifics

Most variables (weekly_sales, temperature, fuel_price, CPI, unemployment) vary by both store and date.

Only the

holiday_flagis common across all stores, and it is highly imbalanced with only about 10% of the weeks marked as holidays.

Holiday Effects and Seasonality

Holiday-Driven Sales Boosts

A visual inspection of the sales data shows clear seasonal spikes that align with holidays. The key holiday periods include:

Valentine’s Day or Superbowl: Typically the 2nd week of February.

Labour Day/Back to School: Around the 1st or 2nd week of September.

Thanksgiving and Black Friday: Generally in the 3rd and/or 4th week of November (around November 24th).

Christmas and New Year: Mostly in the 3rd and/or 4th week of December (close to December 24th).

Independence Day: A boost is visible in a few stores during the 1st week of July (around July 4th).

Seasonal Decomposition Challenges

Although the series exhibits a seasonal pattern, the timing of holiday boosts is irregular.

Standard seasonal decomposition methods (e.g., STL) struggle to capture a “smooth” seasonal component because the holidays are not evenly spaced throughout the year even though the nominal season is 52 weeks.

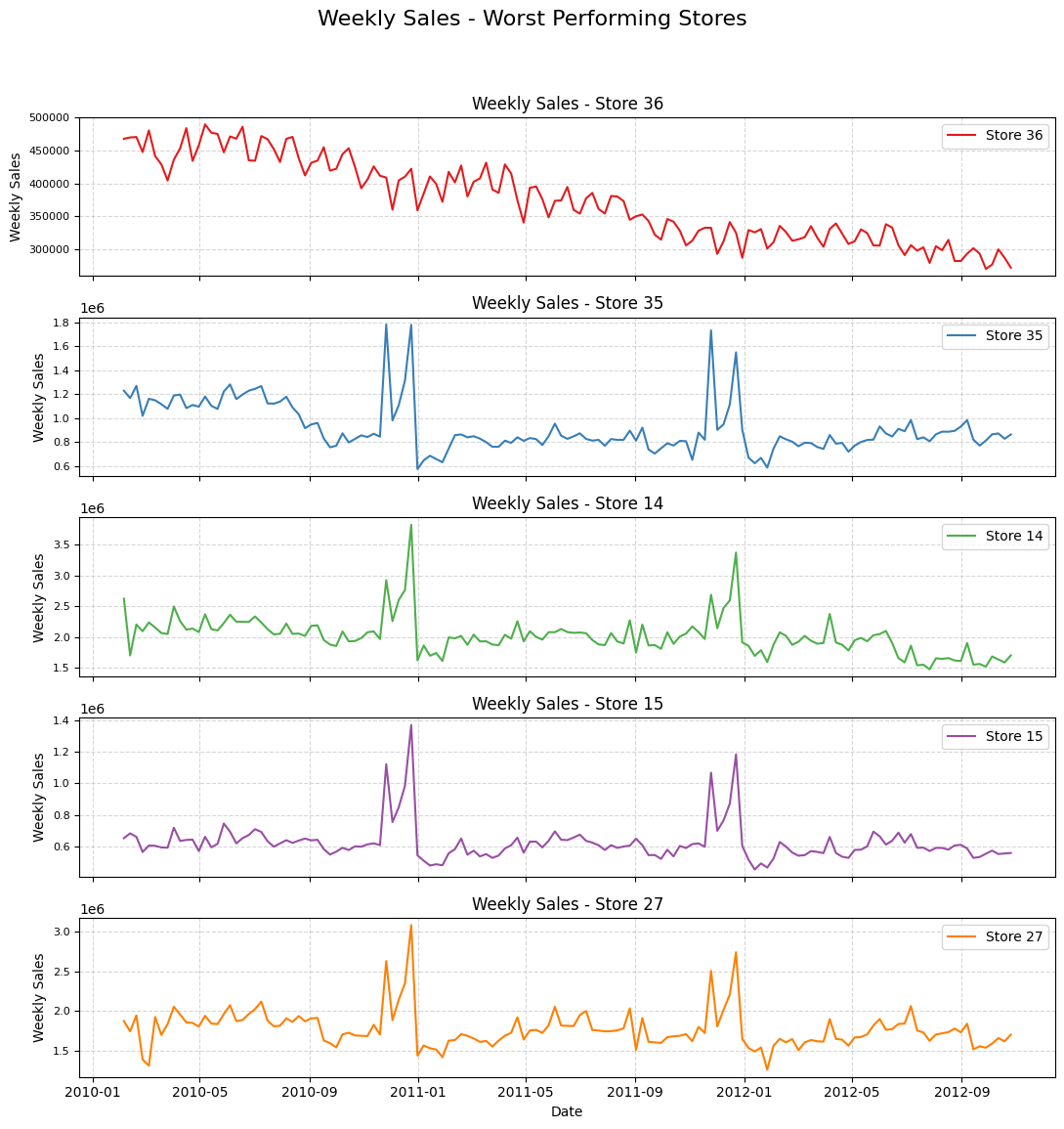

Sales Patterns and Store-Specific Trends

General Trend Behavior

The sales series generally appear additive with clear holiday-induced boosts overlaid on an overall trend.

Notably, Store 36 is an outlier: its weekly sales show a clear downward trend with no apparent seasonal effects.

Impact by Holiday Type

Black Friday and New Year’s show the strongest influence on boosting sales.

Valentine’s Week offers a noticeable, though less significant, increase.

Labour Day appears to make little difference for most stores.

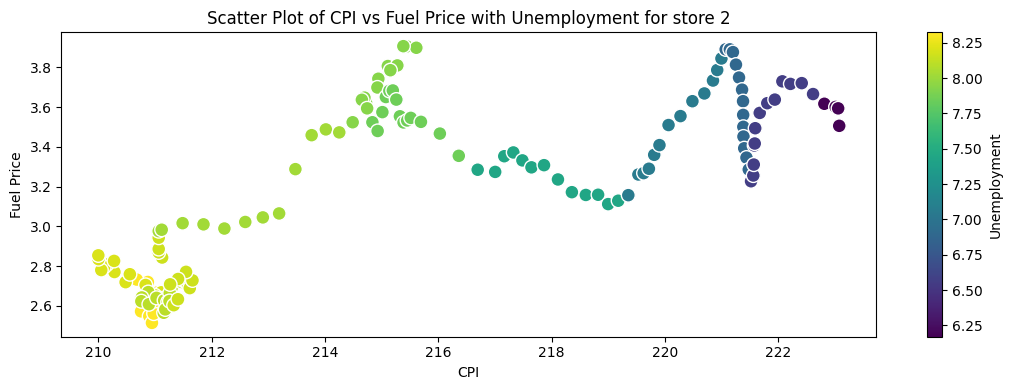

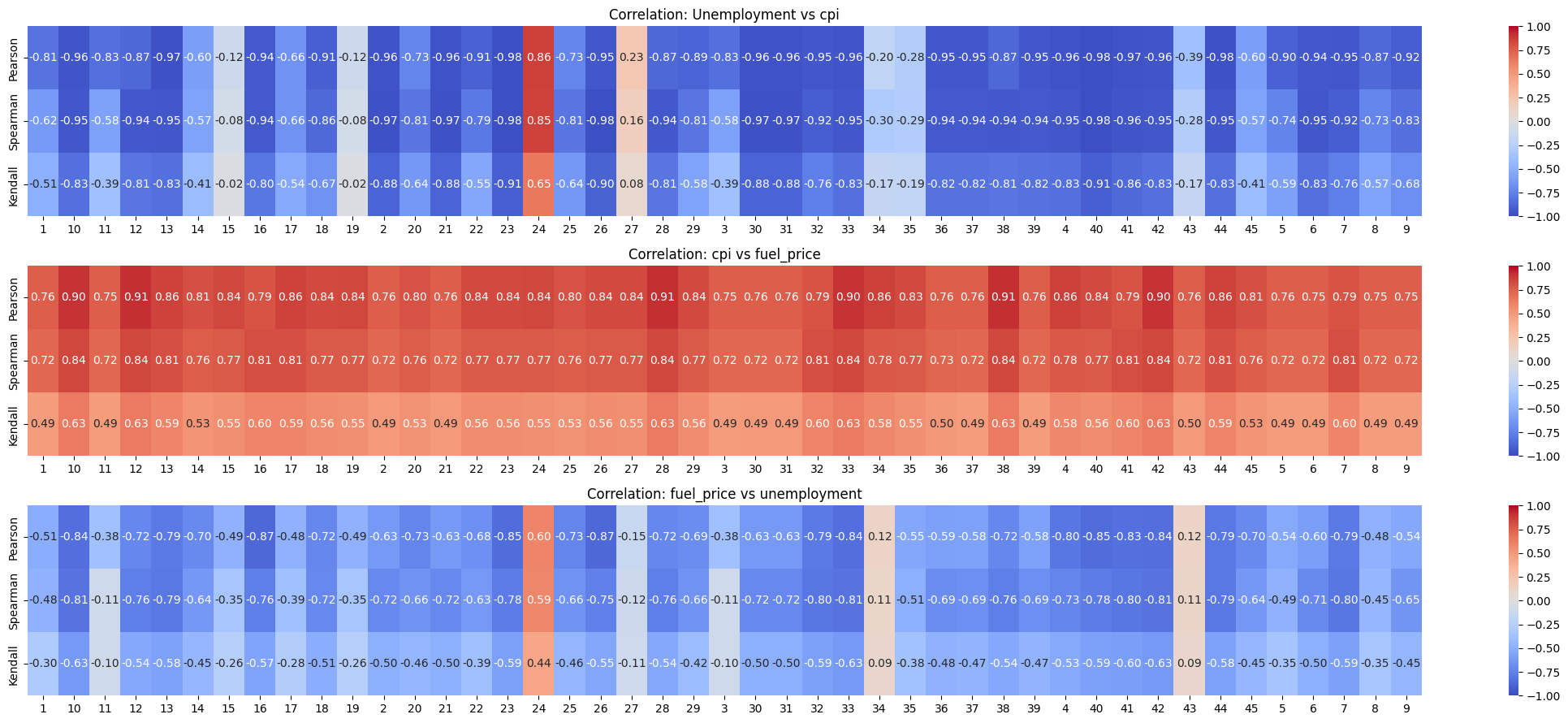

Economic Indicators: CPI, Unemployment, and Fuel Price

Unemployment

When comparing weekly sales with unemployment, the trend component of sales appears more correlated than the raw data.

However, the relationship is inconsistent across stores—sometimes showing strong positive, sometimes strong negative, and occasionally near zero.

Consumer Price Index (CPI) and Fuel Price

Direct correlations between weekly sales and CPI are minimal, but when examining only the trend component, there is a generally significant (often positive) correlation in many stores.

Fuel Price follows a similar pattern as CPI; many stores show positive correlations with sales, yet some exhibit negative or insignificant relationships.

Interrelationships Among Variables

CPI and Fuel Price: These are strongly positively correlated for all stores (average Pearson correlation coefficient of 0.814), which makes sense because fuel cost is an important component of CPI.

Unemployment vs. CPI/Fuel Price: In most cases, unemployment is strongly negatively correlated with both CPI and Fuel Price (with many stores showing correlations greater than 0.73 in magnitude for CPI), though there are exceptions (e.g., Store 24 shows a strong positive correlation).

Dimensionality Reduction with PCA

Purpose:

With only 143 observations per store and several related economic indicators, reducing dimensions can help with model efficiency.Findings:

Reducing CPI, unemployment, and Fuel Price to two principal components captures on average 97% of the variance.

A single principal component only explains about 83% of the variance, making the two-component solution much more effective.

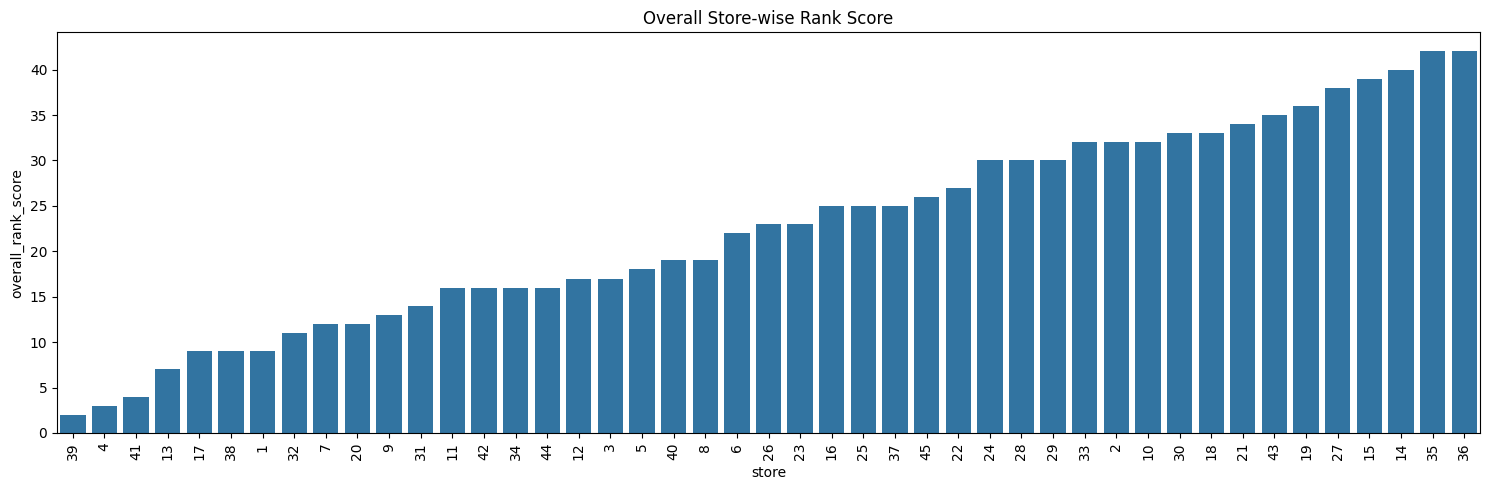

Store Performance Analysis

Developed Metrics

A range of performance measures were considered:Average Sales: Basic measure but influenced by differing sales scales.

Total Relative Sales Growth: Percentage increase from the first to the last week.

Trend-Based Growth (Linear Regression Slope): Captures overall growth over time and is deemed the most robust metric.

Sales Volatility: Based on the normalized residuals from seasonal decomposition, reflecting the stability of sales.

Composite Score: A weighted average of the above metrics where the weights are:

Average Sales: 5%

Relative Growth: 25%

Trend Slope: 60%

Volatility: 10%

Results

The top performers based on the composite score are Stores 39, 4, 41, and 13.

The lower performers include Stores 15, 27, 14, 36, and 35.

Stationarity and Modeling

Stationarity Testing

ADF Test (First Differences):

All stores show strong stationarity with p-values well below the 0.05 threshold.

In the second differencing test, all stores except for 33 and 38 maintained stationarity.

KPSS Test:

For the first difference, nearly all stores support stationarity (with the exception of Store 16).

The second differencing results mimic the first, with Store 16 again showing an exception.

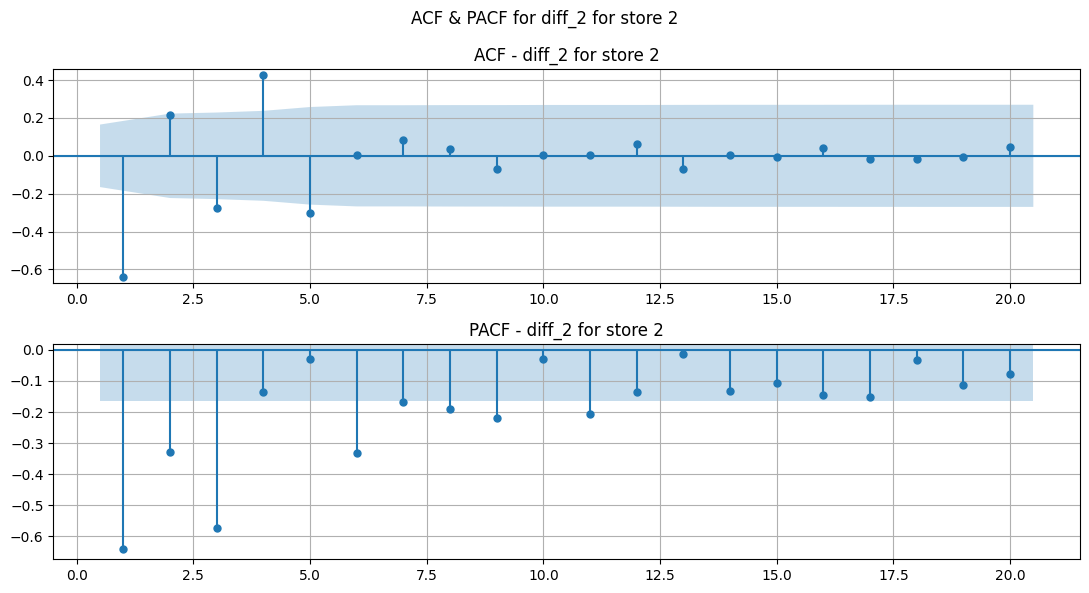

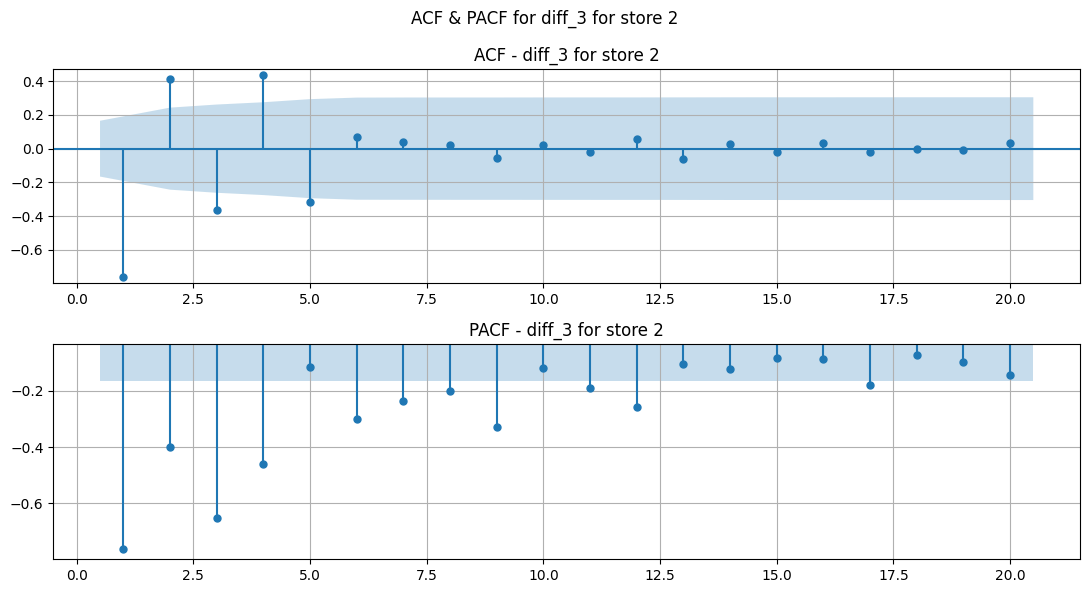

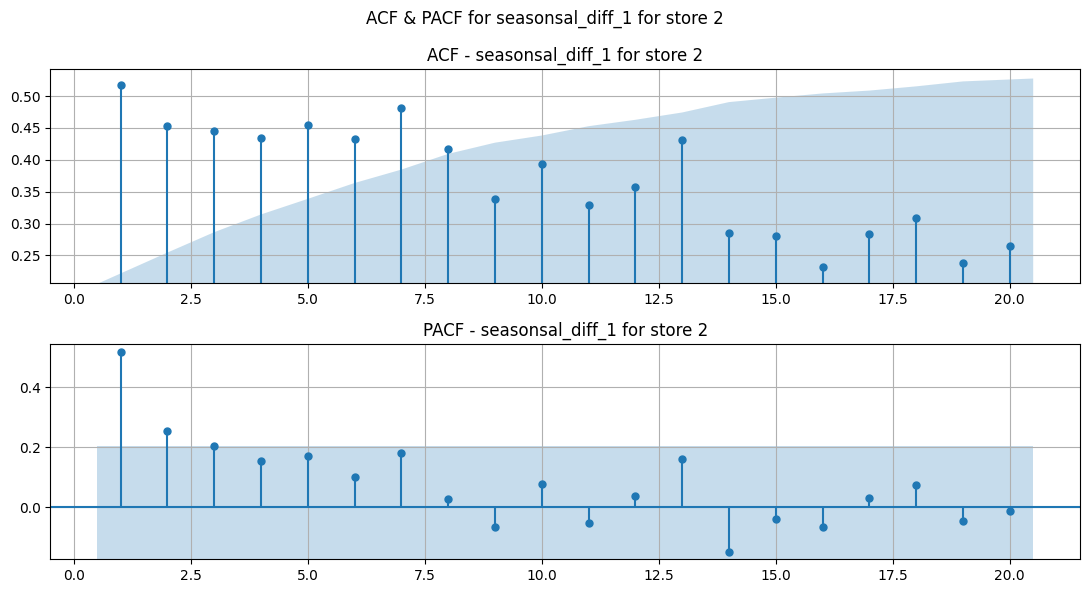

ARIMA and SARIMA Model Candidates

Based on ACF/PACF analyses, candidate orders for AR and MA parts were identified:

Non-seasonal ARIMA models include configurations such as (6, 1, 4), (6, 1, 5), (6, 2, 4), (6, 2, 5), (9, 2, 4), and (9, 2, 5).

Seasonal ARIMA (SARIMA) models add a seasonal component (e.g., (2, 1, 5, 52)) to capture recurring annual patterns.

Summary of Key Takeaways

Holiday Effects Drive Seasonality:

Sales are boosted primarily by holidays. However, because these events do not occur at fixed, regular intervals throughout the year, standard seasonal decomposition methods have difficulty capturing the pattern smoothly.Variability in Economic Impact:

While economic indicators like CPI, unemployment, and Fuel Price do affect sales trends, the strength and direction of their relationships vary considerably by store. Using PCA to reduce these dimensions proves beneficial.Modeling Readiness:

Stationarity tests on differenced series support the use of ARIMA/SARIMA models, with several promising candidate configurations based on our ACF/PACF assessments.Store-Specific Insights:

Composite performance metrics reveal clear differences in store performance, highlighting potential areas for strategic focus (both for high performers and those lagging).

Checking if features vary only with date or store too#

CPI#

temp = df.set_index(['store', 'date'])['cpi'].unstack().T.sample(3).apply(lambda x: round(x, 2))

temp[random.sample(temp.columns.to_list(), 10)]

| store | 30 | 22 | 24 | 17 | 42 | 9 | 6 | 7 | 34 | 45 |

|---|---|---|---|---|---|---|---|---|---|---|

| date | ||||||||||

| 2011-02-25 00:00:00 | 213.190000 | 137.380000 | 133.490000 | 128.130000 | 128.130000 | 217.110000 | 215.070000 | 191.960000 | 128.130000 | 184.160000 |

| 2011-03-25 00:00:00 | 214.250000 | 137.850000 | 133.960000 | 128.620000 | 128.620000 | 218.200000 | 216.140000 | 192.200000 | 128.620000 | 184.990000 |

| 2012-03-23 00:00:00 | 220.920000 | 141.630000 | 137.660000 | 130.900000 | 130.900000 | 225.030000 | 222.890000 | 197.230000 | 130.900000 | 190.540000 |

Temperature#

temp = df.set_index(['store', 'date'])['temperature'].unstack().T.sample(3)

temp[random.sample(temp.columns.to_list(), 10)]

| store | 6 | 8 | 17 | 40 | 39 | 1 | 27 | 43 | 42 | 14 |

|---|---|---|---|---|---|---|---|---|---|---|

| date | ||||||||||

| 2011-07-08 00:00:00 | 88.360000 | 83.570000 | 70.600000 | 67.860000 | 84.330000 | 85.830000 | 76.870000 | 87.020000 | 88.570000 | 77.490000 |

| 2011-05-20 00:00:00 | 72.010000 | 65.540000 | 51.930000 | 56.380000 | 73.310000 | 67.630000 | 60.220000 | 74.210000 | 72.620000 | 62.280000 |

| 2012-04-06 00:00:00 | 71.600000 | 62.180000 | 43.920000 | 36.540000 | 73.490000 | 70.430000 | 48.730000 | 64.700000 | 65.990000 | 49.730000 |

Holidays#

ndf = df.set_index(['store', 'date'])['holiday_flag'].unstack().T.astype(int)

for column in ndf.columns[1:]:

if not (ndf[ndf.columns[0]] == ndf[column]).all():

print(column)

Conclusions/observations#

Except holiday_flag, all other variables like weekly_sales, temperature, fuel_price, cpi, unemployment are unique to each store and date.

holiday_flag is common for all stores.

Univariate and Bivariate Analysis using Ydata Profiling#

# for store in df['store'].unique():

# temp = df.loc[df['store'] == store].drop(columns=['store']).copy()

# report = ProfileReport(temp, title=f'Store {store}')

# report.to_file(f'Reports/store_{store}.html', silent=True)

Miscellaneous Analysis#

df['date'].drop_duplicates().dt.year.value_counts().reset_index().sort_values('date').rename(columns={'date':'Year'})

| Year | count | |

|---|---|---|

| 1 | 2010 | 48 |

| 0 | 2011 | 52 |

| 2 | 2012 | 43 |

The data is incomplete for years 2010 and 2012. So, the yearly cycle needs to be offset while considering 2010 values as the starting point

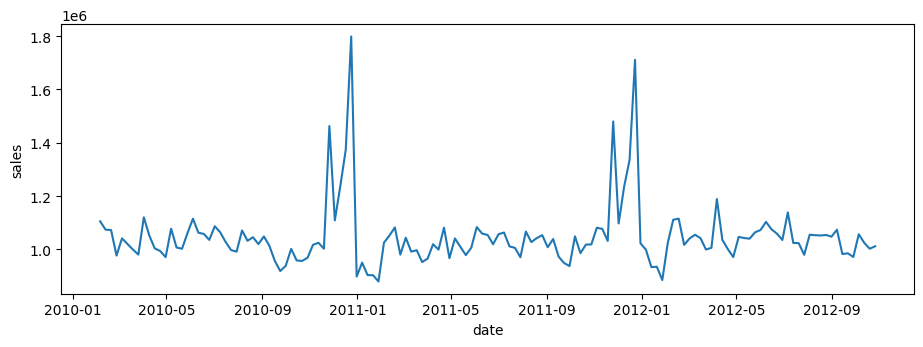

plt.figure(figsize=(11, 3.5))

sns.lineplot(

data=df.pivot_table(index = 'date', columns = 'store', values = 'weekly_sales', observed=True).mean(axis=1).reset_index().rename(columns={0: 'sales'}),

x='date',

y='sales',

)

<Axes: xlabel='date', ylabel='sales'>

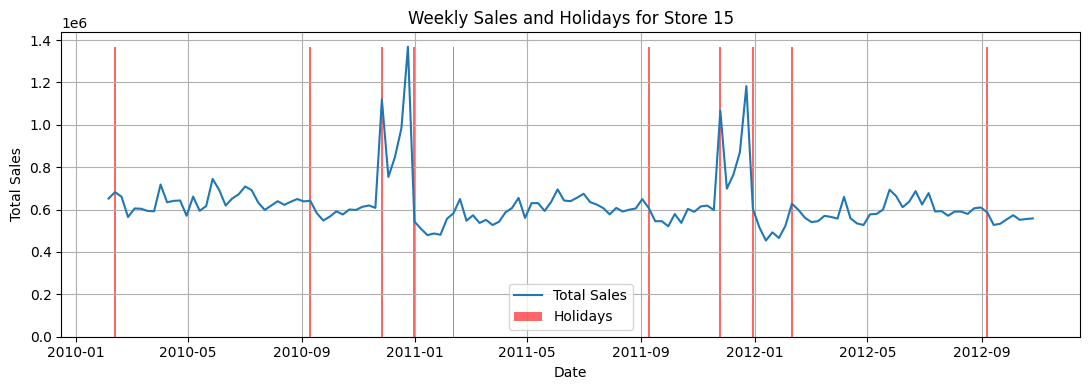

Checking sales with respect to date and holidays#

Show code cell source

# Pivot the table

tdf = df.pivot_table(index='date', columns='store', values='weekly_sales', observed=True)

store = '15'

tdf['total_sales'] = tdf.sum(axis=1)

tdf['holiday_flag'] = df.loc[df['store'] == store].set_index('date')['holiday_flag']

tdf.reset_index(inplace=True)

# Matplotlib/Seaborn code

plt.figure(figsize=(11, 4)) # Adjust figure size for width

# Line plot for weekly sales

sns.lineplot(x='date', y=store, data=tdf, label='Total Sales')

# Bar plot for holidays

plt.bar(tdf['date'], tdf['holiday_flag'].astype(int) * tdf[store].max(),

color='red', alpha=0.6, label='Holidays', width=2)

# Customize the plot

plt.xlabel('Date')

plt.ylabel('Total Sales')

plt.title('Weekly Sales and Holidays for Store ' + store)

plt.legend()

plt.grid(True)

plt.tight_layout() # Adjust layout to prevent labels from overlapping

plt.show()

# Extract the series of holiday dates

holiday_dates = tdf.loc[tdf["holiday_flag"], "date"]

# Create DataFrames for each year

holidays_10 = pd.DataFrame(

holiday_dates[holiday_dates.dt.year == 2010].reset_index(drop=True)

)

holidays_11 = pd.DataFrame(

holiday_dates[holiday_dates.dt.year == 2011].reset_index(drop=True)

)

holidays_12 = pd.DataFrame(

holiday_dates[holiday_dates.dt.year == 2012].reset_index(drop=True)

)

holidays_10.columns = ["date"]

holidays_11.columns = ["date"]

holidays_12.columns = ["date"]

displayHorizontalDataframes([holidays_10, holidays_11, holidays_12], ['Holidays in 2010', 'Holidays in 2011', 'Holidays in 2012'])

Holidays in 2010

| date | |

|---|---|

| 0 | 2010-02-12 |

| 1 | 2010-09-10 |

| 2 | 2010-11-26 |

| 3 | 2010-12-31 |

Holidays in 2011

| date | |

|---|---|

| 0 | 2011-02-11 |

| 1 | 2011-09-09 |

| 2 | 2011-11-25 |

| 3 | 2011-12-30 |

Holidays in 2012

| date | |

|---|---|

| 0 | 2012-02-10 |

| 1 | 2012-09-07 |

Observations#

From visually inspecting the weekly_sales, we can clearly see a seasonal trend. The holiday_flags are mostly set for these occassions:

Valentines day (Feb 2nd week)

Labour day/ back to school (Sep 1st week)

Thanksgiving and Black Friday (Nov 24th weeok)

Christmas and New Years (Dec 25th week)

Also, very few stores also see boost in Sales for Independence day (July 4th week)

From visual inspection, most sales get boosted by Balck Friday and New Years. Valentines week does see some boost in sales but not as significant as others. Labour day does not seem to have a significant impact on sales.

Extra and isolated Holiday effects:

April 6 (specifically 2012)

August 6

June 4 (specifically 2011, 2012)

Store wise Aggregate metrics#

weekly_sales = df.pivot(index='date', columns='store', values='weekly_sales')

wsd = weekly_sales.describe()

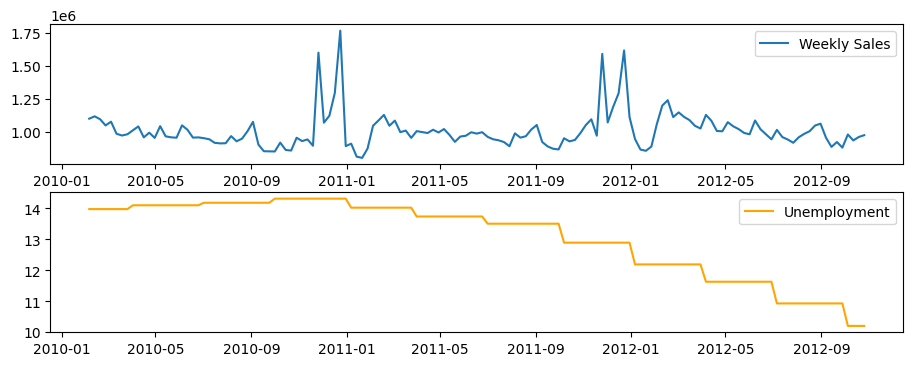

Unemployment Rate Analysis#

Investigate whether the weekly sales are affected by the unemployment rate.

Identify which stores are suffering the most if an effect exists.

Sales and Unemployment comparison#

df_store = df[df['store'] == '12']

fig, ax = plt.subplots(2, 1, figsize=(11, 4))

ax[0].plot(df_store['date'], df_store['weekly_sales'], label='Weekly Sales')

ax[1].plot(df_store['date'], df_store['unemployment'], label='Unemployment', color='orange')

ax[0].legend()

ax[1].legend()

plt.show()

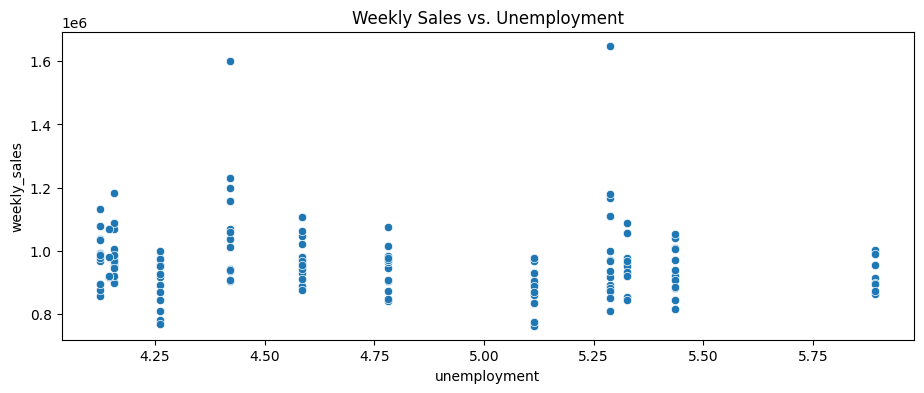

From Visual inspection of Weekly sales and Unemployment side-byside, no direct correlation can be observed between sales and unemployment rate. However, seasonal decompose might tell us something

df_store = df[df['store'] == '40']

plt.figure(figsize=(11, 4))

sns.scatterplot(x='unemployment', y='weekly_sales', data=df_store)

plt.title('Weekly Sales vs. Unemployment')

# plt.show()

pearson = df_store['weekly_sales'].corr(df_store['unemployment'], method='pearson')

print(f"Pearson Correlation between unemployment and weekly sales: {pearson}")

spearman = df_store['weekly_sales'].corr(df_store['unemployment'], method='spearman')

print(f"Spearman Correlation between unemployment and weekly sales: {spearman}")

kendall = df_store['weekly_sales'].corr(df_store['unemployment'], method='kendall')

print(f"Kendall Correlation between unemployment and weekly sales: {kendall}")

Pearson Correlation between unemployment and weekly sales: -0.11252795058812329

Spearman Correlation between unemployment and weekly sales: -0.1605059665705267

Kendall Correlation between unemployment and weekly sales: -0.11418063280775571

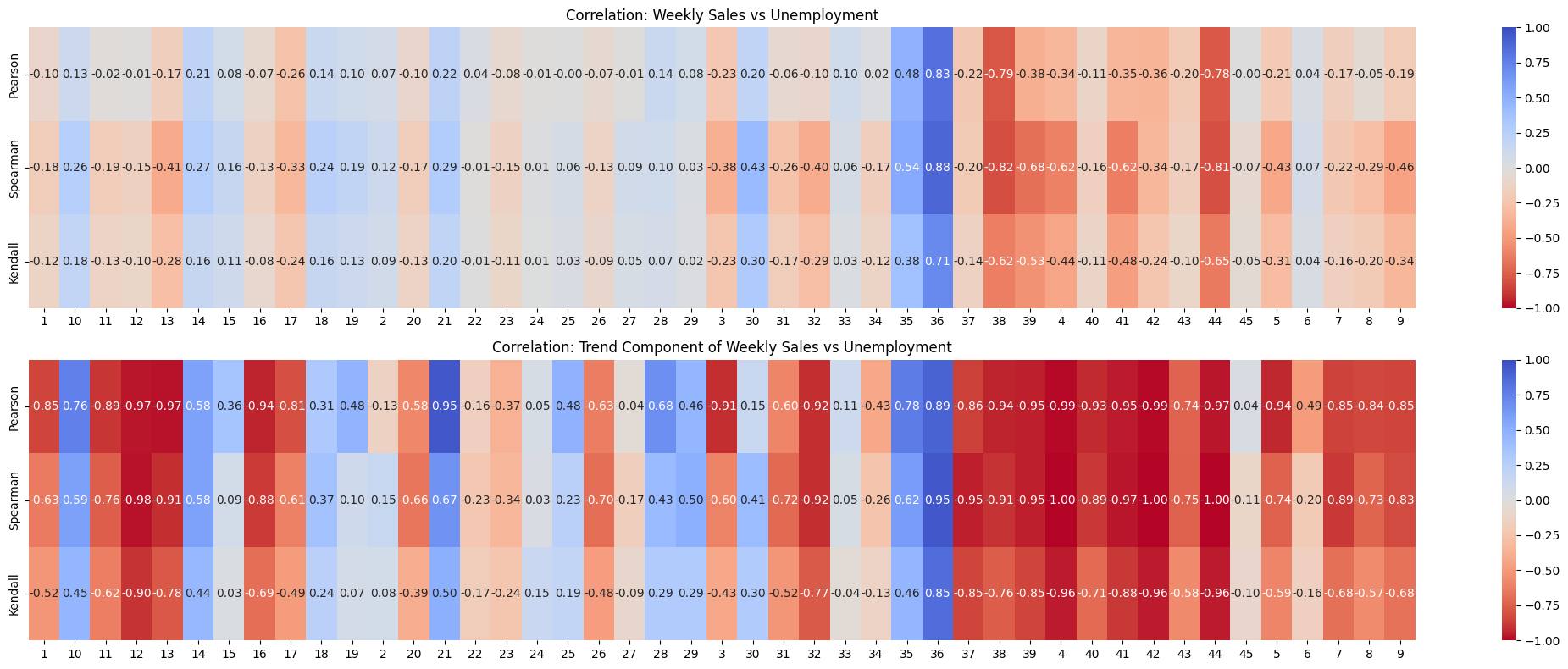

Correlation between unemployment rate and sales#

Show code cell source

# Extract unique stores

stores = sorted(df['store'].unique()) # Sort for consistent order

# Initialize correlation storage

correlation_sales = pd.DataFrame(index=['Pearson', 'Spearman', 'Kendall'], columns=stores)

correlation_trend = pd.DataFrame(index=['Pearson', 'Spearman', 'Kendall'], columns=stores)

# Compute correlations for each store

for store in stores:

df_store = df[df['store'] == store].sort_values('date').set_index('date')

# Extract weekly sales and unemployment

y = df_store['weekly_sales']

unemployment = df_store['unemployment']

# Compute correlations (Weekly Sales vs Unemployment)

correlation_sales.loc['Pearson', store] = y.corr(unemployment, method='pearson')

correlation_sales.loc['Spearman', store] = y.corr(unemployment, method='spearman')

correlation_sales.loc['Kendall', store] = y.corr(unemployment, method='kendall')

# Perform STL decomposition

stl = STL(y, seasonal=53) # Assuming yearly seasonality

result = stl.fit()

# Extract trend component

df_store['trend'] = result.trend

# Compute correlations (Trend vs Unemployment)

correlation_trend.loc['Pearson', store] = df_store['trend'].corr(unemployment, method='pearson')

correlation_trend.loc['Spearman', store] = df_store['trend'].corr(unemployment, method='spearman')

correlation_trend.loc['Kendall', store] = df_store['trend'].corr(unemployment, method='kendall')

# Convert to float type (for better plotting)

correlation_sales = correlation_sales.astype(float)

correlation_trend = correlation_trend.astype(float)

# Plot heatmaps

fig, axes = plt.subplots(2, 1, figsize=(21, 8), gridspec_kw={'height_ratios': [1, 1]})

# Sales vs Unemployment Heatmap

sns.heatmap(correlation_sales, cmap='coolwarm_r', annot=True, fmt=".2f", ax=axes[0], vmin=-1, vmax=1)

axes[0].set_title("Correlation: Weekly Sales vs Unemployment")

# Trend vs Unemployment Heatmap

sns.heatmap(correlation_trend, cmap='coolwarm_r', annot=True, fmt=".2f", ax=axes[1], vmin=-1, vmax=1)

axes[1].set_title("Correlation: Trend Component of Weekly Sales vs Unemployment")

# Adjust layout

plt.tight_layout()

plt.show()

Observations#

Looking at it, the trend component of weekly sales is definitely more correlated with unemployment than regular weekly_sales. But, there’s high contrast in how it’s correlated. For most of the stores, it’s strongly negative. For some other stores it’s strongly positive. Few times it’s close to zero. So, I’m not sure if it’s a good indicator of whether there’s a relationship between weekly_sales and unemployment.

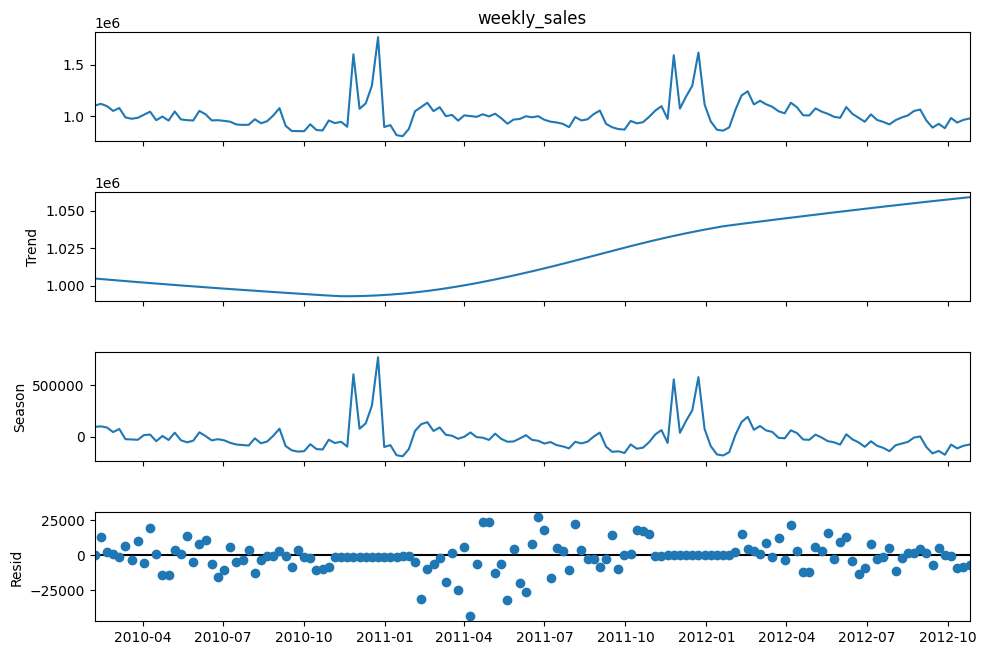

Decomposition of Store-wise Weekly Sales#

STL Decomposition of weekly_sales for selected stores#

store = '12'

df_store = df[df['store'] == store]

df_store = df_store.sort_values('date').set_index('date') # ensure chronological order

# Set weekly_sales as the target series

y = df_store['weekly_sales']

# We assume an annual (52-week) seasonal period

stl = STL(y, period = 52, seasonal=53, robust=False, low_pass = 53)

result = stl.fit()

fig = result.plot()

fig.set_size_inches(11, 7)

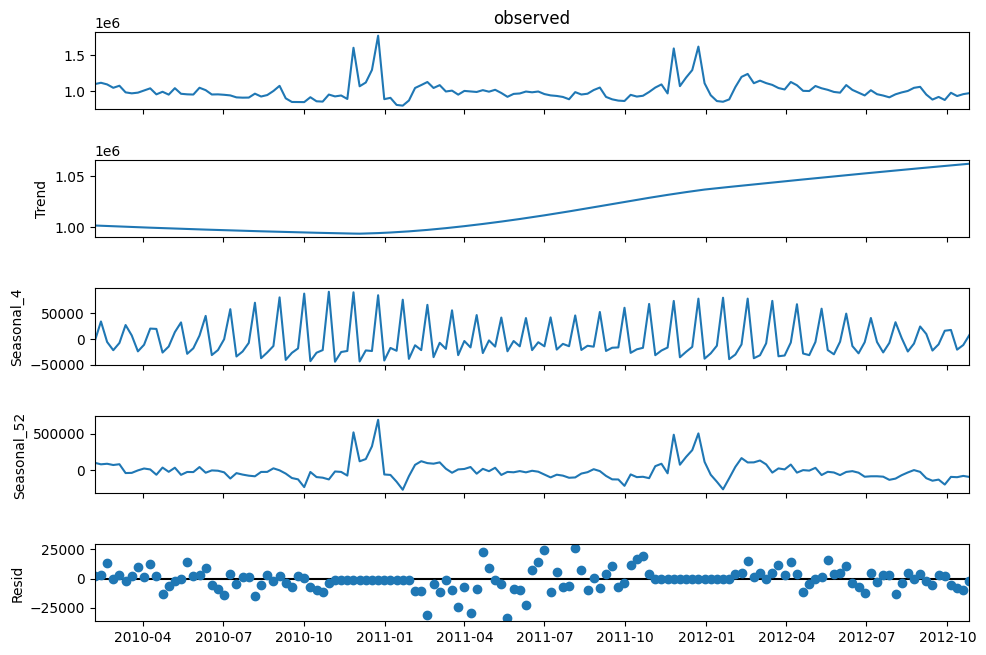

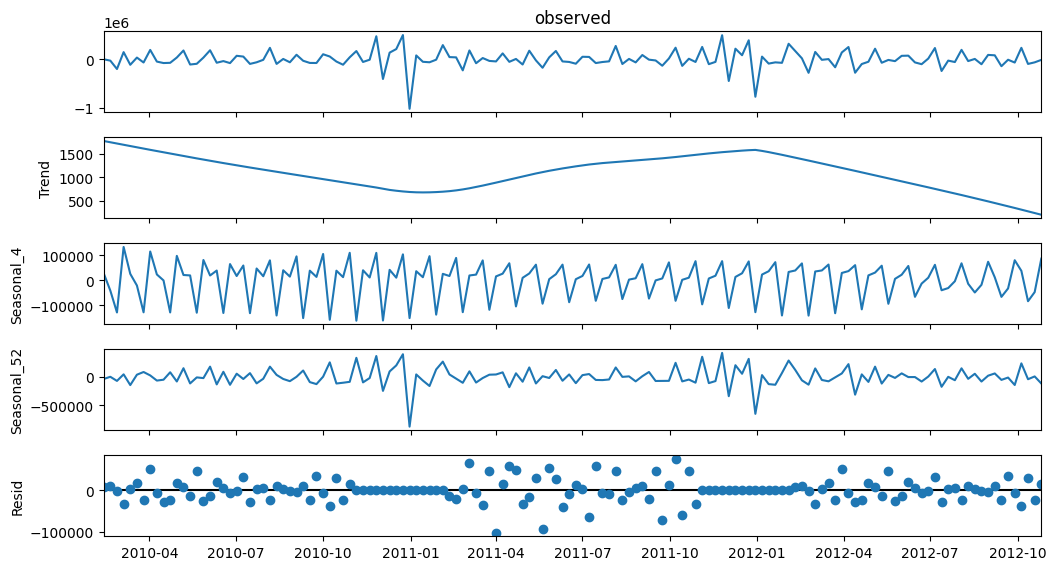

MSTL to capture monthly and annual seasonality separately?#

df_store = df[df['store'] == '12']

df_store = df_store.sort_values('date').set_index('date') # ensure chronological order

# Set weekly_sales as the target series

y = df_store['weekly_sales']

mstl = MSTL(y, periods=[4, 52], iterate=5)

result = mstl.fit()

fig = result.plot()

fig.set_size_inches(11, 7)

plt.show()

Observations#

From visual inspection of the Times series decomposition plot using STL and MSTL, what I noticed is it cannot properly decompose the sales into a “nice” continuous seasonal component. The seasonal effect is directly due to the recurring holiday sales boots, but they are randomly distributed over the year and repeat yearly. It’s not like every month there’s a holiday at a fixed interval. They are inconsistently distributed. So, technically the season is 52 weeks long. But, the seasonal effect is not efficiently captured by the STL decomposition.

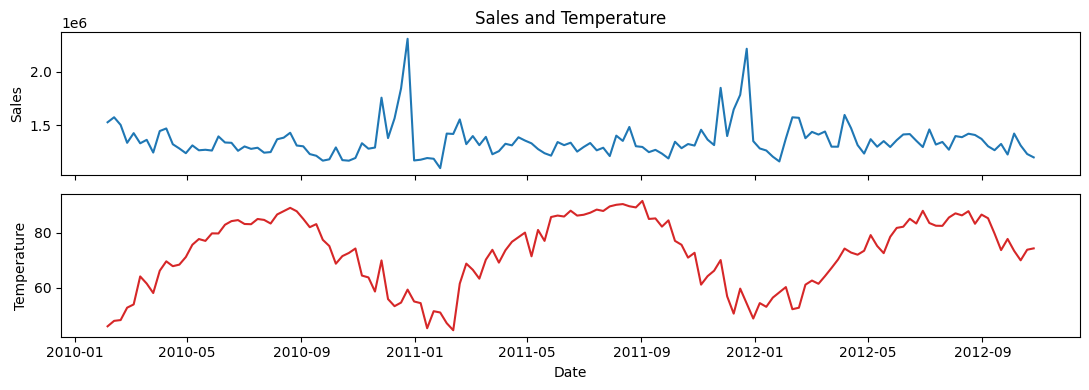

Temperature Effect#

Examine if temperature influences weekly sales.

store = '11'

df_store = df[df['store'] == store].sort_values('date').set_index('date')

# Create stacked subplots

fig, (ax1, ax2) = plt.subplots(2, 1, sharex=True, figsize=(11, 4))

ax1.plot(df_store.index, df_store['weekly_sales'], color='tab:blue')

ax1.set(ylabel='Sales', title='Sales and Temperature')

ax2.plot(df_store.index, df_store['temperature'], color='tab:red')

ax2.set(xlabel='Date', ylabel='Temperature')

plt.tight_layout()

plt.show()

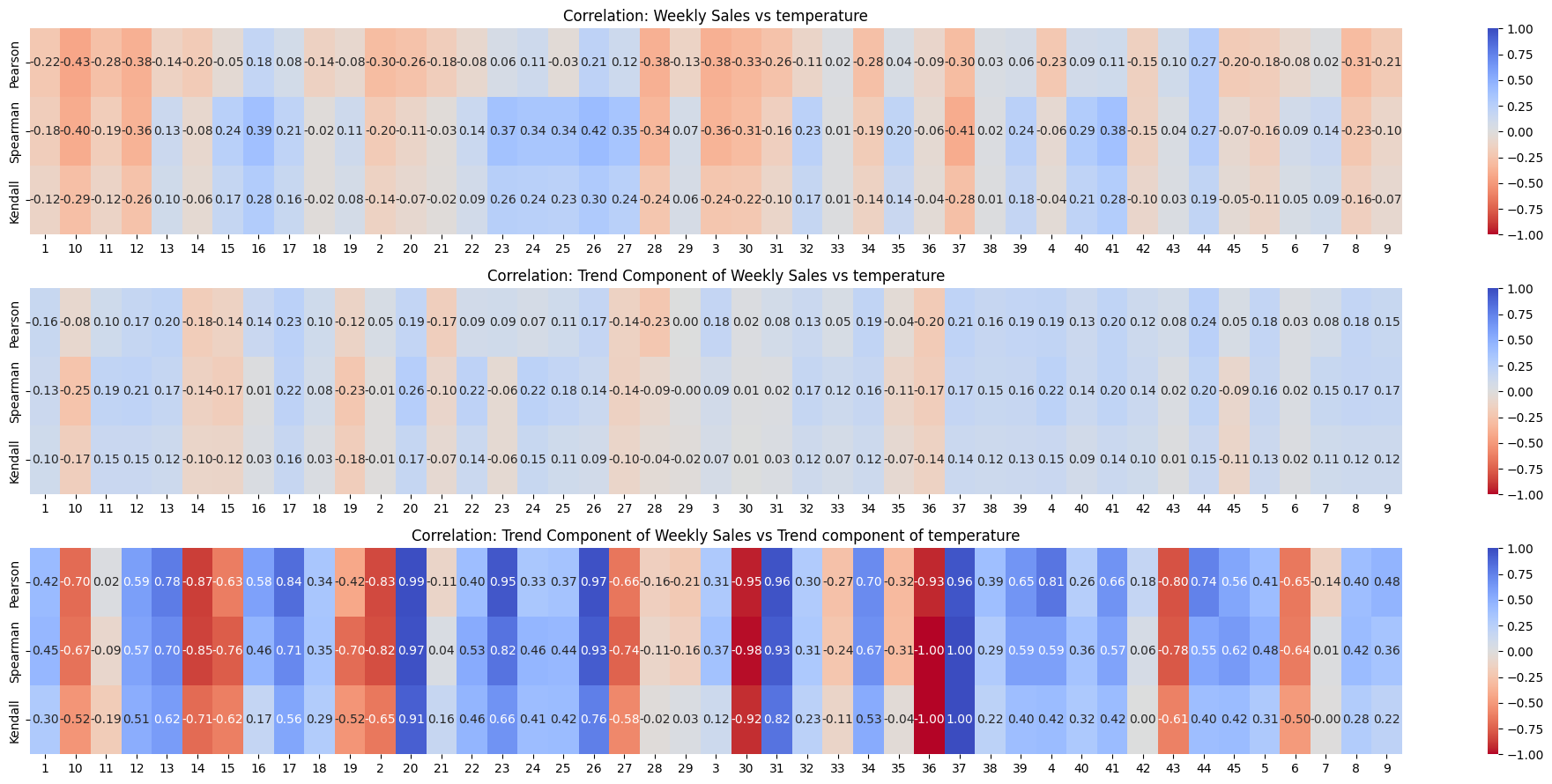

Checking correlation between weekly_sales and temperature#

Show code cell source

# Extract unique stores

stores = sorted(df['store'].unique()) # Sort for consistent order

# Initialize correlation storage

correlation_sales = pd.DataFrame(index=['Pearson', 'Spearman', 'Kendall'], columns=stores)

correlation_trend = pd.DataFrame(index=['Pearson', 'Spearman', 'Kendall'], columns=stores)

correlation_double_trend = pd.DataFrame(index=['Pearson', 'Spearman', 'Kendall'], columns=stores)

# Compute correlations for each store

for store in stores:

df_store = df[df['store'] == store].sort_values('date').set_index('date')

# Extract weekly sales and temperature

y = df_store['weekly_sales']

temperature = df_store['temperature']

# Compute correlations (Weekly Sales vs Unemployment)

correlation_sales.loc['Pearson', store] = y.corr(temperature, method='pearson')

correlation_sales.loc['Spearman', store] = y.corr(temperature, method='spearman')

correlation_sales.loc['Kendall', store] = y.corr(temperature, method='kendall')

# Perform STL decomposition

stl = STL(y, seasonal=53) # Assuming yearly seasonality

result = stl.fit()

# Extract trend component

df_store['trend'] = result.trend

# Compute correlations (Trend vs temperature)

correlation_trend.loc['Pearson', store] = df_store['trend'].corr(temperature, method='pearson')

correlation_trend.loc['Spearman', store] = df_store['trend'].corr(temperature, method='spearman')

correlation_trend.loc['Kendall', store] = df_store['trend'].corr(temperature, method='kendall')

# Perform STL decomposition

stl2 = STL(df_store['temperature'], seasonal=53) # Assuming yearly seasonality

result = stl2.fit()

# Extract trend component

df_store['temperature_trend'] = result.trend

# Compute correlations (Trend vs temperature)

correlation_double_trend.loc['Pearson', store] = df_store['trend'].corr(df_store['temperature_trend'], method='pearson')

correlation_double_trend.loc['Spearman', store] = df_store['trend'].corr(df_store['temperature_trend'], method='spearman')

correlation_double_trend.loc['Kendall', store] = df_store['trend'].corr(df_store['temperature_trend'], method='kendall')

# Convert to float type (for better plotting)

correlation_sales = correlation_sales.astype(float)

correlation_trend = correlation_trend.astype(float)

correlation_double_trend = correlation_double_trend.astype(float)

# Plot heatmaps

fig, axes = plt.subplots(3, 1, figsize=(20, 9), gridspec_kw={'height_ratios': [1, 1, 1]})

# Sales vs temperature Heatmap

sns.heatmap(correlation_sales, cmap='coolwarm_r', annot=True, fmt=".2f", ax=axes[0], vmin=-1, vmax=1)

axes[0].set_title("Correlation: Weekly Sales vs temperature")

# Trend vs temperature Heatmap

sns.heatmap(correlation_trend, cmap='coolwarm_r', annot=True, fmt=".2f", ax=axes[1], vmin=-1, vmax=1)

axes[1].set_title("Correlation: Trend Component of Weekly Sales vs temperature")

# Trend vs temperature trend Heatmap

sns.heatmap(correlation_double_trend, cmap='coolwarm_r', annot=True, fmt=".2f", ax=axes[2], vmin=-1, vmax=1)

axes[2].set_title("Correlation: Trend Component of Weekly Sales vs Trend component of temperature")

# Adjust layout

plt.tight_layout()

plt.show()

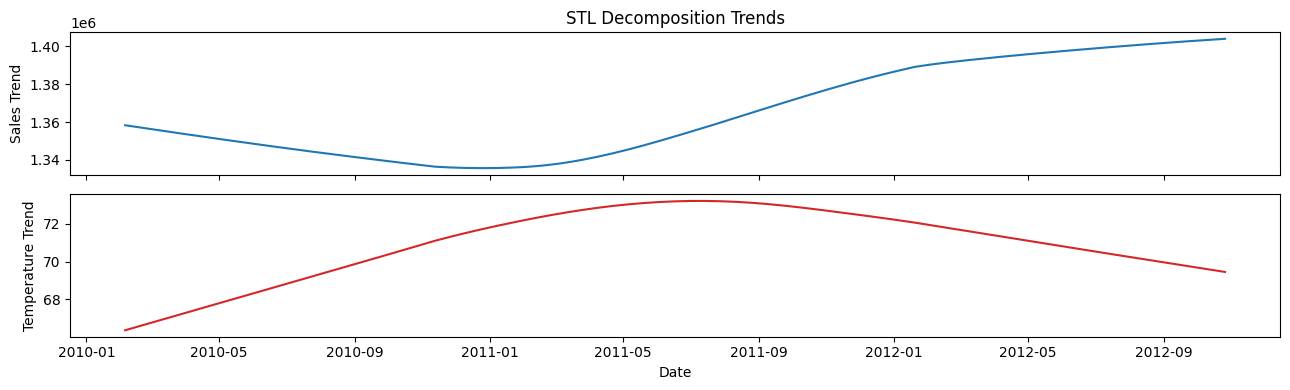

store = '11'

df_store = df[df['store'] == store].sort_values('date').set_index('date')

# Perform STL decomposition for both series

decomp_sales = STL(df_store['weekly_sales'], period=52, seasonal = 53, robust=False).fit()

decomp_temp = STL(df_store['temperature'], period=52, seasonal = 53, robust=False).fit()

# Create stacked subplots

fig, (ax1, ax2) = plt.subplots(2, 1, sharex=True, figsize=(13, 4))

ax1.plot(df_store.index, decomp_sales.trend, color='tab:blue')

ax1.set(ylabel='Sales Trend', title='STL Decomposition Trends')

ax2.plot(df_store.index, decomp_temp.trend, color='tab:red')

ax2.set(xlabel='Date', ylabel='Temperature Trend')

plt.tight_layout()

plt.show()

Observations#

From visual inspection of the correlation heatmaps, weekly sales are definitely not correlated with temperature.

No need for further hypothesis testing to determine if there is a relationship between temperature and weekly sales.

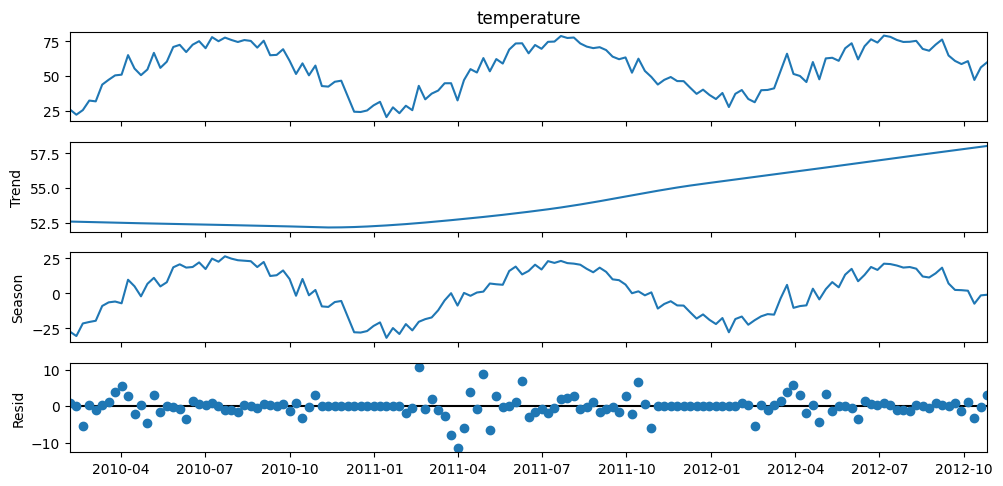

Seasonal Decomposition of Temperature#

store = '20'

df_store = df[df['store'] == store].sort_values('date').set_index('date')

# Set weekly_sales as the target series

y = df_store['temperature']

# We assume an annual (52-week) seasonal period

stl = STL(y, period = 52, seasonal=53, robust=False, low_pass = 53)

result = stl.fit()

fig = result.plot()

fig.set_size_inches(11, 5)

Observations#

From visual inspection, temperature is obviously seasonal, with peaks in summer (American season)

Consumer Price Index#

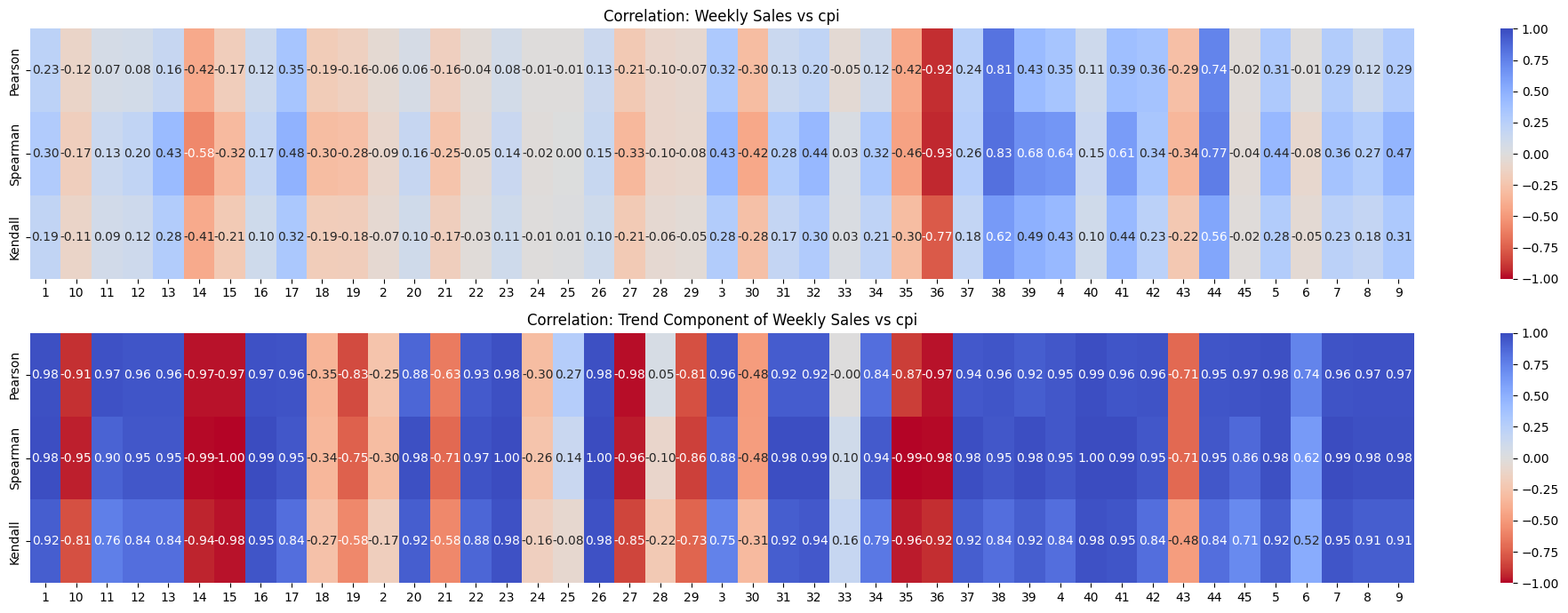

Checking correlation between weekly_sales and its trend component with CPI#

Show code cell source

# Extract unique stores

stores = sorted(df['store'].unique()) # Sort for consistent order

# Initialize correlation storage

correlation_sales = pd.DataFrame(index=['Pearson', 'Spearman', 'Kendall'], columns=stores)

correlation_trend = pd.DataFrame(index=['Pearson', 'Spearman', 'Kendall'], columns=stores)

# Compute correlations for each store

for store in stores:

df_store = df[df['store'] == store].sort_values('date').set_index('date')

# Extract weekly sales and cpi

y = df_store['weekly_sales']

cpi = df_store['cpi']

# Compute correlations (Weekly Sales vs Unemployment)

correlation_sales.loc['Pearson', store] = y.corr(cpi, method='pearson')

correlation_sales.loc['Spearman', store] = y.corr(cpi, method='spearman')

correlation_sales.loc['Kendall', store] = y.corr(cpi, method='kendall')

# Perform STL decomposition

stl = STL(y, seasonal=53, period = 52, robust=True) # Assuming yearly seasonality

result = stl.fit()

# Extract trend component

df_store['trend'] = result.trend

# Compute correlations (Trend vs cpi)

correlation_trend.loc['Pearson', store] = df_store['trend'].corr(cpi, method='pearson')

correlation_trend.loc['Spearman', store] = df_store['trend'].corr(cpi, method='spearman')

correlation_trend.loc['Kendall', store] = df_store['trend'].corr(cpi, method='kendall')

# Convert to float type (for better plotting)

correlation_sales = correlation_sales.astype(float)

correlation_trend = correlation_trend.astype(float)

# Plot heatmaps

fig, axes = plt.subplots(2, 1, figsize=(20, 7), gridspec_kw={'height_ratios': [1, 1]})

# Sales vs cpi Heatmap

sns.heatmap(correlation_sales, cmap='coolwarm_r', annot=True, fmt=".2f", ax=axes[0], vmin=-1, vmax=1)

axes[0].set_title("Correlation: Weekly Sales vs cpi")

# Trend vs cpi Heatmap

sns.heatmap(correlation_trend, cmap='coolwarm_r', annot=True, fmt=".2f", ax=axes[1], vmin=-1, vmax=1)

axes[1].set_title("Correlation: Trend Component of Weekly Sales vs cpi")

# Adjust layout

plt.tight_layout()

plt.show()

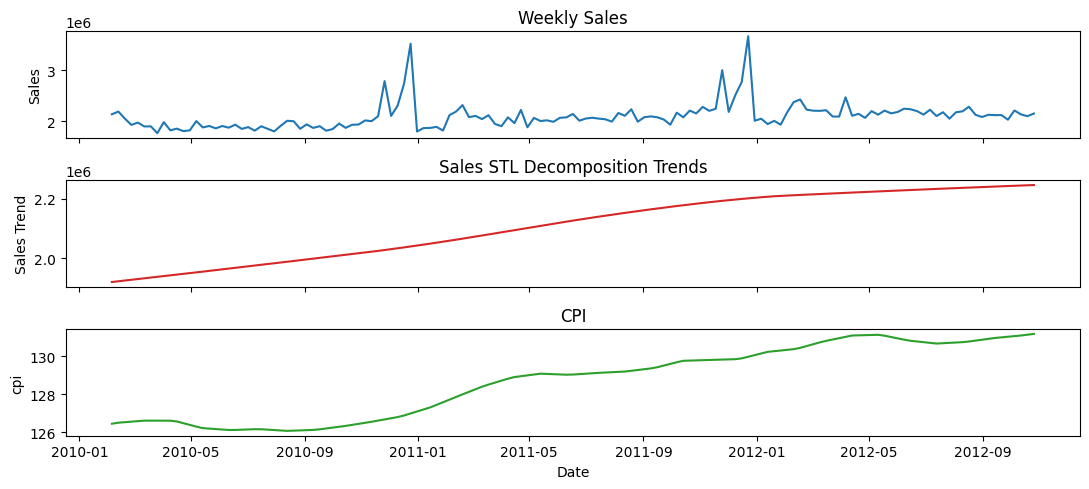

store = '4'

df_store = df[df['store'] == store].sort_values('date').set_index('date')

# Perform STL decomposition for both series

decomp_sales = STL(df_store['weekly_sales'], period=52, seasonal = 53, robust=False).fit()

# decomp_temp = STL(df_store['cpi'], period=52, seasonal = 53, robust=False).fit()

cpi = df_store['cpi']

# Create stacked subplots

fig, (ax1, ax2, ax3) = plt.subplots(3, 1, sharex=True, figsize=(11, 5))

ax1.plot(df_store.index, df_store['weekly_sales'], color='tab:blue')

ax1.set(ylabel='Sales', title='Weekly Sales')

ax2.plot(df_store.index, decomp_sales.trend, color='tab:red')

ax2.set(ylabel='Sales Trend', title='Sales STL Decomposition Trends')

ax3.plot(df_store.index, cpi, color='tab:green')

ax3.set(xlabel='Date', ylabel='cpi', title='CPI')

plt.tight_layout()

plt.show()

Observations#

When looking at weekly_sales and cpi directly, the correlations is insignificant. But, when considering only the trend component with respect to CPI, there seems to be a significant correlation.

Most of the correlations are strongly positive. Very few are strongly negative. And even fewer are weakly positive or negative.

If for all stores the correlations were in same direction with significant magnitude, then it would hold some meaning. But, it doesn’t.

Fuel Price#

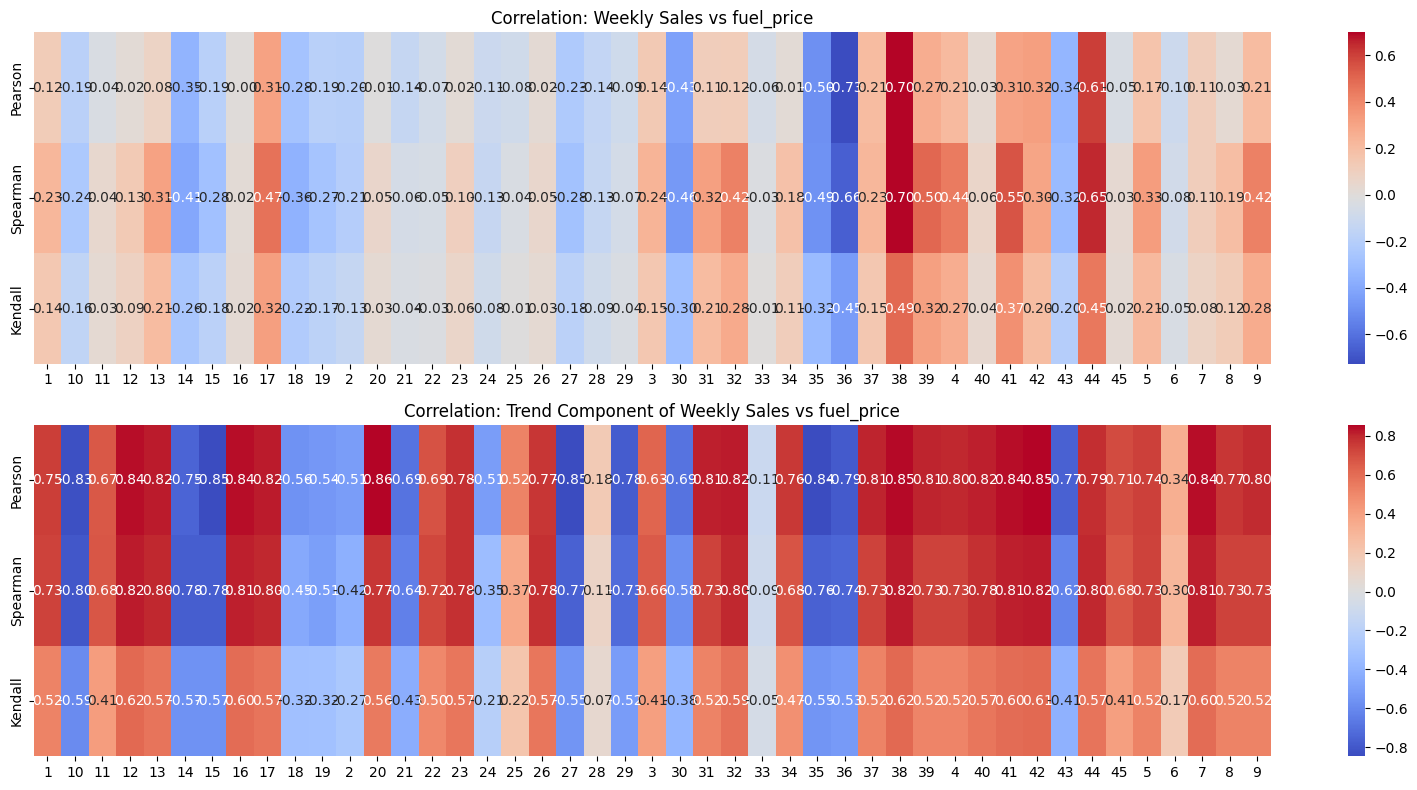

Checking correlation between weekly_sales and its trend component with Fuel Price#

Show code cell source

# Extract unique stores

stores = sorted(df['store'].unique()) # Sort for consistent order

# Initialize correlation storage

correlation_sales = pd.DataFrame(index=['Pearson', 'Spearman', 'Kendall'], columns=stores)

correlation_trend = pd.DataFrame(index=['Pearson', 'Spearman', 'Kendall'], columns=stores)

# Compute correlations for each store

for store in stores:

df_store = df[df['store'] == store].sort_values('date').set_index('date')

# Extract weekly sales and fuel_price

y = df_store['weekly_sales']

fuel_price = df_store['fuel_price']

# Compute correlations (Weekly Sales vs Unemployment)

correlation_sales.loc['Pearson', store] = y.corr(fuel_price, method='pearson')

correlation_sales.loc['Spearman', store] = y.corr(fuel_price, method='spearman')

correlation_sales.loc['Kendall', store] = y.corr(fuel_price, method='kendall')

# Perform STL decomposition

stl = STL(y, seasonal=53, period = 52, robust=True) # Assuming yearly seasonality

result = stl.fit()

# Extract trend component

df_store['trend'] = result.trend

# Compute correlations (Trend vs fuel_price)

correlation_trend.loc['Pearson', store] = df_store['trend'].corr(fuel_price, method='pearson')

correlation_trend.loc['Spearman', store] = df_store['trend'].corr(fuel_price, method='spearman')

correlation_trend.loc['Kendall', store] = df_store['trend'].corr(fuel_price, method='kendall')

# Convert to float type (for better plotting)

correlation_sales = correlation_sales.astype(float)

correlation_trend = correlation_trend.astype(float)

# Plot heatmaps

fig, axes = plt.subplots(2, 1, figsize=(16, 8), gridspec_kw={'height_ratios': [1, 1]})

# Sales vs fuel_price Heatmap

sns.heatmap(correlation_sales, cmap='coolwarm', annot=True, fmt=".2f", ax=axes[0])

axes[0].set_title("Correlation: Weekly Sales vs fuel_price")

# Trend vs fuel_price Heatmap

sns.heatmap(correlation_trend, cmap='coolwarm', annot=True, fmt=".2f", ax=axes[1])

axes[1].set_title("Correlation: Trend Component of Weekly Sales vs fuel_price")

# Adjust layout

plt.tight_layout()

plt.show()

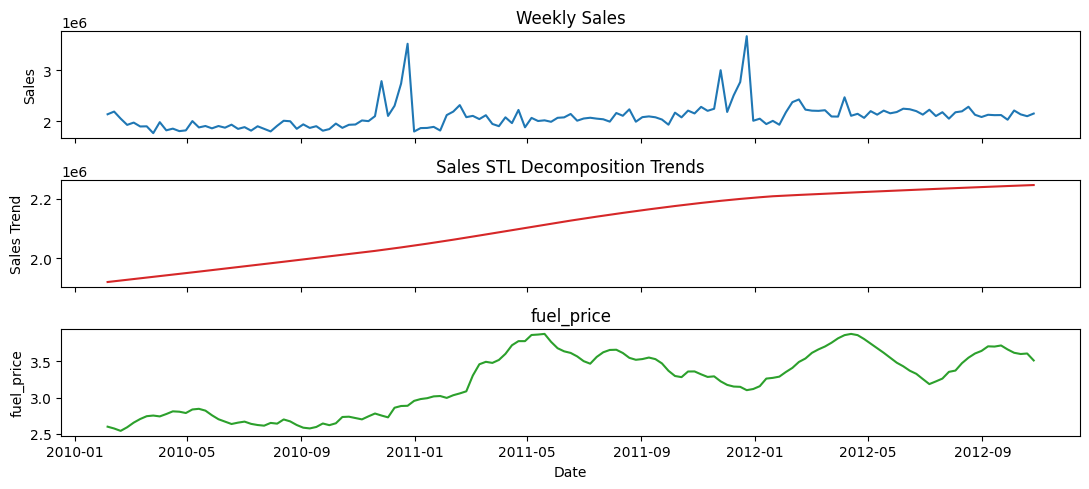

store = '4'

df_store = df[df['store'] == store].sort_values('date').set_index('date')

# Perform STL decomposition for both series

decomp_sales = STL(df_store['weekly_sales'], period=52, seasonal = 53, robust=False).fit()

# decomp_temp = STL(df_store['cpi'], period=52, seasonal = 53, robust=False).fit()

fuel_price = df_store['fuel_price']

# Create stacked subplots

fig, (ax1, ax2, ax3) = plt.subplots(3, 1, sharex=True, figsize=(11, 5))

ax1.plot(df_store.index, df_store['weekly_sales'], color='tab:blue')

ax1.set(ylabel='Sales', title='Weekly Sales')

ax2.plot(df_store.index, decomp_sales.trend, color='tab:red')

ax2.set(ylabel='Sales Trend', title='Sales STL Decomposition Trends')

ax3.plot(df_store.index, fuel_price, color='tab:green')

ax3.set(xlabel='Date', ylabel='fuel_price', title='fuel_price')

plt.tight_layout()

plt.show()

Observations#

Similar to CPI, Fuel Price also for most stores seems to have a strong positive correlation with the sales.

However, similar to CPI, Fuel Price some of the stores seems to have a negative or insignificant correlation with the sales.

So, Fuel Price is not a good “global” indicator of the sales.

Store Performance Analysis#

Performance metrics:

Average sales:

This won’t be a good metric as the scale of sales differs across stores.

But, it can be a good starting point.

Total relative growth irrespective of seasons and trends

Basically percentage growth of sales from first week to last week.

This is relatively a better metric compared to the previous one. But, it might still be susceptible to volatility in first and last weeks.

Total relative growth in terms of trend only

What this metric does is fits a linear regression model to the growth of sales over time.

And then, the slope of the regression line is this metric.

This is a better metric than both the previous ones, because it accounts for all the data along with its trend.

Stability/volatility of sales

This metric analyzes the volatility of sales relative to the trend.

It is measured by the standard deviation of the residuals of seasonal decomposition of sales.

Note: Since the scale of sales differs across stores, I normalize the residuals to bring them on scale of 1 to -1.

Then their standard deviation is multiplied by 100 to give us final percentage volatility.

Composite score based on all the above metrics

This is the final metric that combines all the above metrics.

It is calculated by taking the weighted average of all the metrics.

The weights are based on the importance of each metric.

Average sales: 5%

Relative percentage growth: 25%

Linear Trend slope: 60%

Volatility: 10%

Calculating all metrics and corresponding store ranks#

Show code cell source

stores = df['store'].unique()

performance_records = []

for store_id in stores:

# 1. Subset data

df_store = df.loc[df['store'] == store_id].copy()

df_store = df_store.sort_values(by='date').set_index('date')

# 3. Decompose using STL (assuming ~52-week season)

stl = STL(df_store['weekly_sales'], period=52, robust=False)

res = stl.fit()

df_store['trend'] = res.trend

df_store['seasonal'] = res.seasonal

df_store['remainder'] = res.resid

# 4. Compute Trend Slope (via Linear Regression)

# Create a numeric index for regression

df_store['t'] = np.arange(len(df_store))

model = LinearRegression()

model.fit(df_store[['t']], df_store['trend'])

slope = model.coef_[0]

# 5. Compute % Growth from first to last

# start_trend = (df_store['trend'] + df_store['remainder']).iloc[0]

# end_trend = (df_store['trend'] + df_store['remainder']).iloc[-1]

start_trend = df_store['trend'].iloc[0]

end_trend = df_store['trend'].iloc[-1]

pct_growth = ((end_trend - start_trend) / start_trend) * 100 if start_trend != 0 else np.nan

# 6. Compute remainder volatility

# Compute the minimum and maximum of the residuals for the current store

res_min = df_store['remainder'].min()

res_max = df_store['remainder'].max()

# Apply min-max normalization to map residuals to the range [-1, 1]

if res_max - res_min != 0:

df_store['norm_remainder'] = 2 * (

(df_store['remainder'] - res_min) / (res_max - res_min)

) - 1

else:

# If all residuals are the same, assign 0 (their normalized value)

df_store['norm_remainder'] = 0

# Now compute the standard deviation of the normalized residuals,

# and multiply by 100 to express it as a percentage volatility.

volatility_norm_percent = df_store['norm_remainder'].std() * 100

# 7. Collect performance metrics

performance_records.append({

'store': store_id,

'avg_sales': df_store['weekly_sales'].mean(),

'trend_slope': slope,

'pct_growth': pct_growth,

'pct_volatility': volatility_norm_percent

})

performance_df = pd.DataFrame(performance_records)

Show code cell source

def rank_performance(performance_df):

# Higher is better

performance_df['rank_avg_sales'] = performance_df['avg_sales'].rank(method='dense', ascending=False)

performance_df['rank_slope'] = performance_df['trend_slope'].rank(method='dense', ascending=False)

performance_df['rank_pct_growth'] = performance_df['pct_growth'].rank(method='dense', ascending=False)

# Lower is better for volatility

performance_df['rank_volatility'] = performance_df['pct_volatility'].rank(method='dense', ascending=True)

# Example: Weighted sum of ranks

performance_df['overall_rank_score'] = (

performance_df['rank_avg_sales']*0.05 +

performance_df['rank_slope']*0.6 +

performance_df['rank_pct_growth']*0.25 +

performance_df['rank_volatility']*0.1

)

performance_df['overall_rank'] = performance_df['overall_rank_score'].rank(method='dense', ascending=True)

return performance_df

performance_df = rank_performance(performance_df)

performance_df['avg_sales'] = performance_df['avg_sales'].astype(int)

performance_df['pct_growth'] = performance_df['pct_growth'].round(2)

performance_df['trend_slope'] = performance_df['trend_slope'].round(2)

performance_df['pct_volatility'] = performance_df['pct_volatility'].round(6)

for column in [column for column in performance_df.columns if 'rank' in column]:

performance_df[column] = performance_df[column].astype(int)

performance_df.head(5)

| store | avg_sales | trend_slope | pct_growth | pct_volatility | rank_avg_sales | rank_slope | rank_pct_growth | rank_volatility | overall_rank_score | overall_rank | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 1 | 1555264 | 1127.120000 | 10.580000 | 26.402651 | 9 | 5 | 12 | 35 | 9 | 7 |

| 1 | 2 | 1925751 | -184.000000 | -1.090000 | 25.439569 | 5 | 36 | 30 | 31 | 32 | 34 |

| 2 | 3 | 402704 | 381.560000 | 13.390000 | 20.941098 | 40 | 20 | 11 | 9 | 17 | 18 |

| 3 | 4 | 2094712 | 2627.790000 | 18.640000 | 22.665105 | 2 | 1 | 6 | 15 | 3 | 2 |

| 4 | 5 | 318011 | 348.750000 | 16.090000 | 22.180238 | 43 | 21 | 9 | 12 | 18 | 19 |

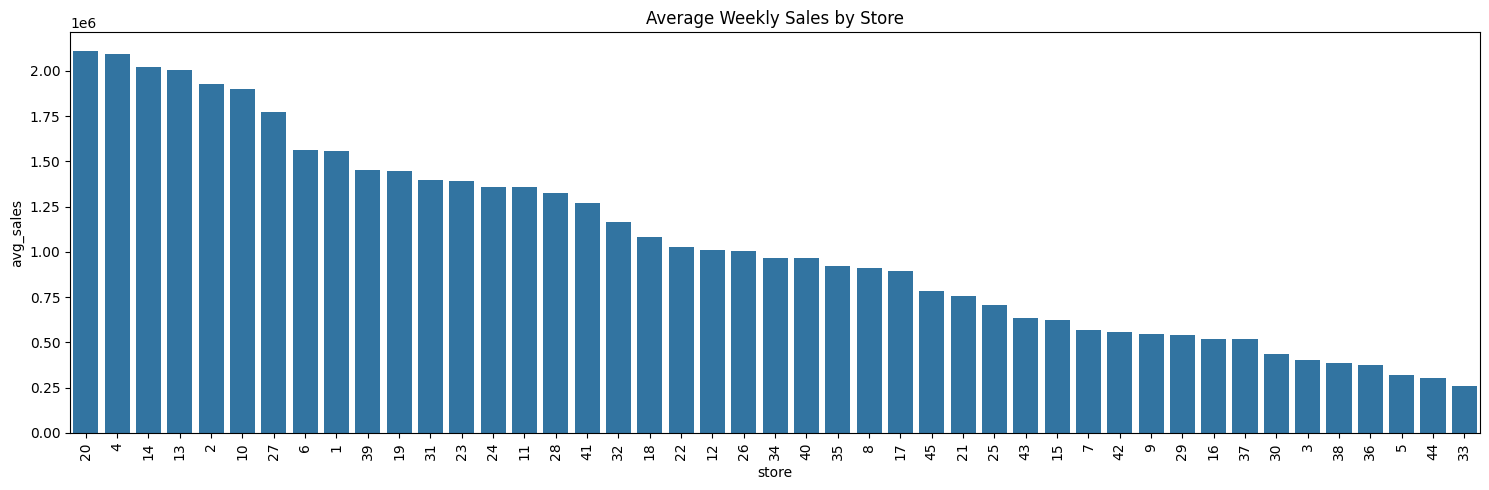

Average Weekly Sales#

store_sales_summary = (

performance_df[['avg_sales', 'rank_avg_sales', 'store']].copy()

)

store_sales_summary.sort_values('rank_avg_sales', ascending=True, inplace=True)

store_sales_summary.set_index('store', inplace=True)

displayHorizontalDataframes(

[store_sales_summary.head(5), store_sales_summary.tail(5)],

['Top 5 Best performing stores', 'Bottom 5 Worst performing stores'],

)

Top 5 Best performing stores

| avg_sales | rank_avg_sales | |

|---|---|---|

| store | ||

| 20 | 2107676 | 1 |

| 4 | 2094712 | 2 |

| 14 | 2020978 | 3 |

| 13 | 2003620 | 4 |

| 2 | 1925751 | 5 |

Bottom 5 Worst performing stores

| avg_sales | rank_avg_sales | |

|---|---|---|

| store | ||

| 38 | 385731 | 41 |

| 36 | 373511 | 42 |

| 5 | 318011 | 43 |

| 44 | 302748 | 44 |

| 33 | 259861 | 45 |

print(

"Total sales difference between Top performer and worst performer",

(store_sales_summary['avg_sales'].head(1).values[0] - store_sales_summary['avg_sales'].tail(1).values[0])

)

Total sales difference between Top performer and worst performer 1847815

# Sort stores by average weekly sales descending

sorted_df = store_sales_summary.sort_values(by='avg_sales', ascending=False).reset_index()

plt.figure(figsize=(15, 5))

sns.barplot(

data=sorted_df,

x='store',

y='avg_sales',

order=sorted_df['store']

)

plt.title('Average Weekly Sales by Store')

plt.xticks(rotation=90)

plt.tight_layout()

plt.show()

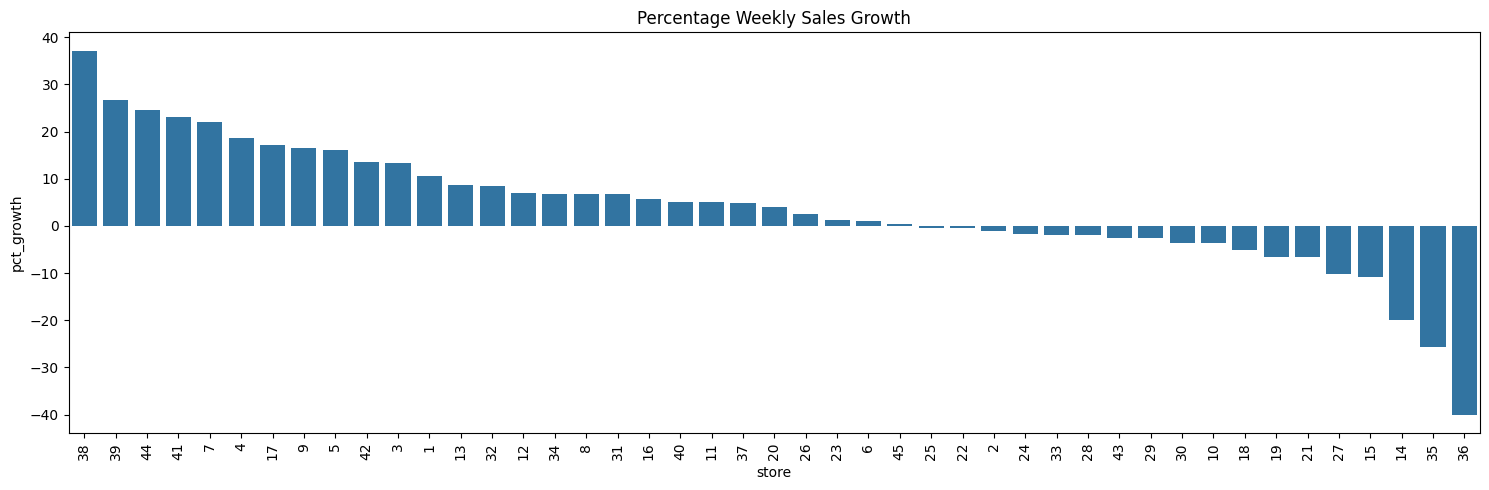

Percentage Growth in Sales#

store_sales_summary = (

performance_df[['pct_growth', 'rank_pct_growth', 'store']].copy()

)

store_sales_summary.sort_values('rank_pct_growth', ascending=True, inplace=True)

store_sales_summary.set_index('store', inplace=True)

displayHorizontalDataframes(

[store_sales_summary.head(5), store_sales_summary.tail(5)],

['Top 5 Best performing stores', 'Bottom 5 Worst performing stores'],

)

Top 5 Best performing stores

| pct_growth | rank_pct_growth | |

|---|---|---|

| store | ||

| 38 | 37.19 | 1 |

| 39 | 26.75 | 2 |

| 44 | 24.48 | 3 |

| 41 | 23.13 | 4 |

| 7 | 21.94 | 5 |

Bottom 5 Worst performing stores

| pct_growth | rank_pct_growth | |

|---|---|---|

| store | ||

| 27 | -10.22 | 41 |

| 15 | -10.92 | 42 |

| 14 | -19.99 | 43 |

| 35 | -25.64 | 44 |

| 36 | -40.05 | 45 |

# Sort stores by average weekly sales descending

sorted_df = store_sales_summary.sort_values(by='pct_growth', ascending=False).reset_index()

plt.figure(figsize=(15, 5))

sns.barplot(

data=sorted_df,

x='store',

y='pct_growth',

order=sorted_df['store']

)

plt.title('Percentage Weekly Sales Growth')

plt.xticks(rotation=90)

plt.tight_layout()

# plt.grid(True)

plt.show()

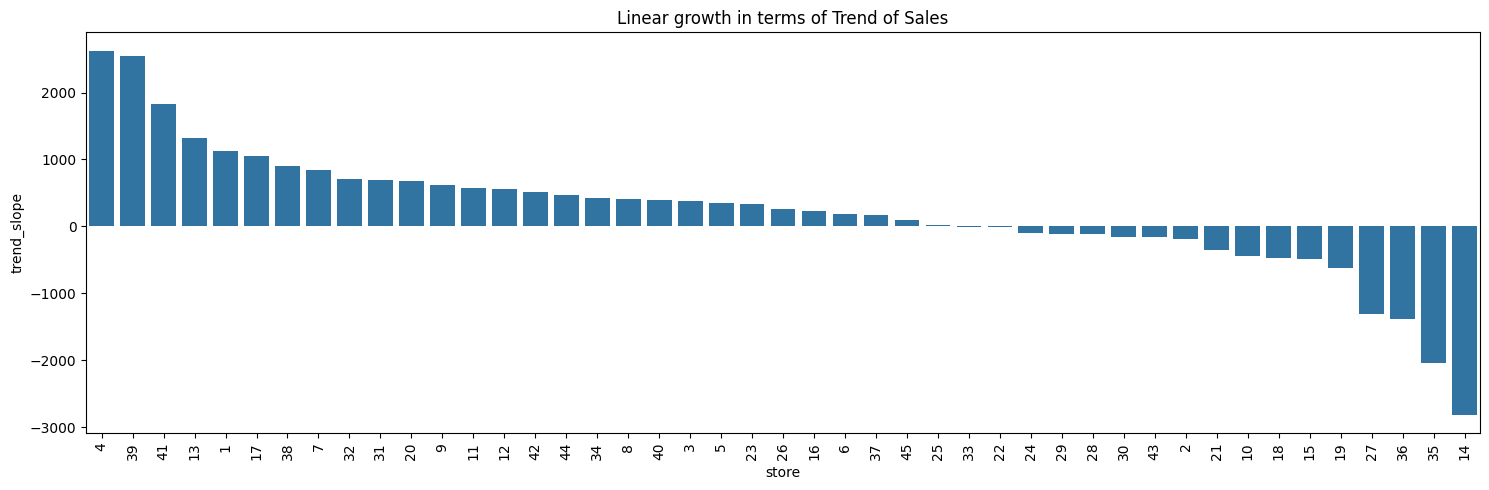

Linear growth in terms of Trend of Weekly Sales#

store_sales_summary = (

performance_df[['trend_slope', 'rank_slope', 'store']].copy()

)

store_sales_summary.sort_values('rank_slope', ascending=True, inplace=True)

store_sales_summary.set_index('store', inplace=True)

displayHorizontalDataframes(

[store_sales_summary.head(5), store_sales_summary.tail(5)],

['Top 5 Best performing stores', 'Bottom 5 Worst performing stores'],

)

Top 5 Best performing stores

| trend_slope | rank_slope | |

|---|---|---|

| store | ||

| 4 | 2627.79 | 1 |

| 39 | 2547.94 | 2 |

| 41 | 1826.76 | 3 |

| 13 | 1328.49 | 4 |

| 1 | 1127.12 | 5 |

Bottom 5 Worst performing stores

| trend_slope | rank_slope | |

|---|---|---|

| store | ||

| 19 | -628.11 | 41 |

| 27 | -1311.62 | 42 |

| 36 | -1378.94 | 43 |

| 35 | -2036.21 | 44 |

| 14 | -2814.30 | 45 |

# Sort stores by average weekly sales descending

sorted_df = store_sales_summary.sort_values(by='trend_slope', ascending=False).reset_index()

plt.figure(figsize=(15, 5))

sns.barplot(

data=sorted_df,

x='store',

y='trend_slope',

order=sorted_df['store']

)

plt.title('Linear growth in terms of Trend of Sales')

plt.xticks(rotation=90)

plt.tight_layout()

# plt.grid(True)

plt.show()

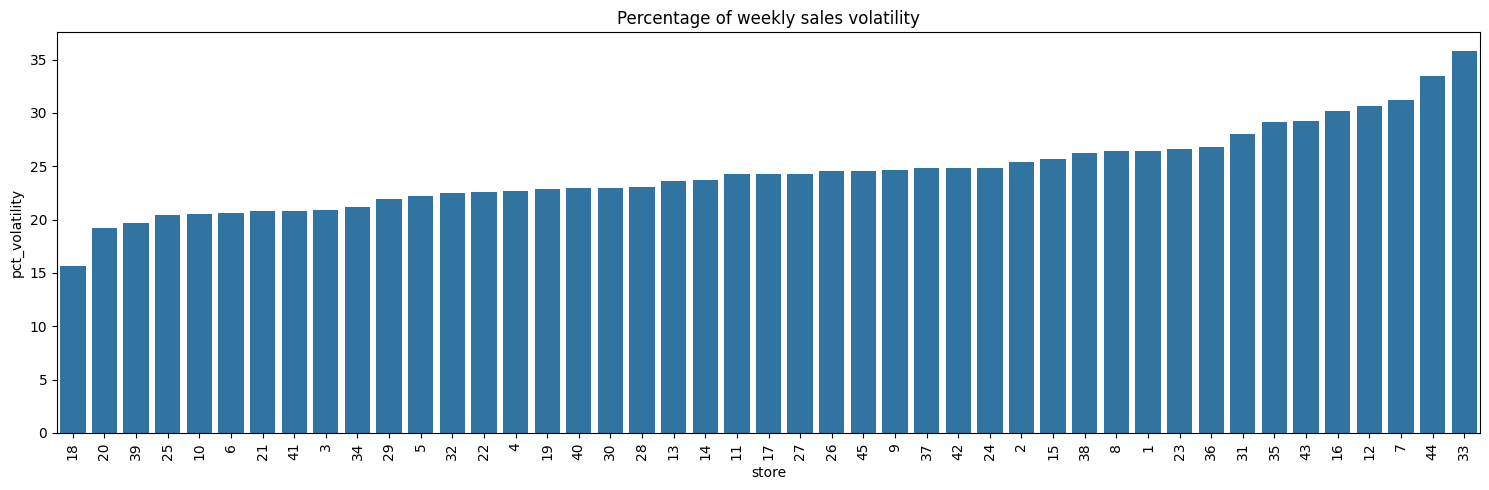

Volatility of Sales#

store_sales_summary = (

performance_df[['pct_volatility', 'rank_volatility', 'store']].copy()

)

store_sales_summary.sort_values('rank_volatility', ascending=True, inplace=True)

store_sales_summary.set_index('store', inplace=True)

displayHorizontalDataframes(

[store_sales_summary.head(5), store_sales_summary.tail(5)],

['Top 5 Best performing stores', 'Bottom 5 Worst performing stores'],

)

Top 5 Best performing stores

| pct_volatility | rank_volatility | |

|---|---|---|

| store | ||

| 18 | 15.627316 | 1 |

| 20 | 19.201057 | 2 |

| 39 | 19.659181 | 3 |

| 25 | 20.449854 | 4 |

| 10 | 20.552056 | 5 |

Bottom 5 Worst performing stores

| pct_volatility | rank_volatility | |

|---|---|---|

| store | ||

| 16 | 30.215278 | 41 |

| 12 | 30.694709 | 42 |

| 7 | 31.261097 | 43 |

| 44 | 33.493021 | 44 |

| 33 | 35.770149 | 45 |

# Sort stores by average weekly sales descending

sorted_df = store_sales_summary.sort_values(by='pct_volatility', ascending=True).reset_index()

plt.figure(figsize=(15, 5))

sns.barplot(

data=sorted_df,

x='store',

y='pct_volatility',

order=sorted_df['store']

)

plt.title('Percentage of weekly sales volatility')

plt.xticks(rotation=90)

plt.tight_layout()

# plt.grid(True)

plt.show()

Composite Metric#

store_sales_summary = (

performance_df[['overall_rank_score', 'overall_rank', 'store']].copy()

)

store_sales_summary.sort_values('overall_rank', ascending=True, inplace=True)

store_sales_summary.set_index('store', inplace=True)

displayHorizontalDataframes(

[store_sales_summary.head(5), store_sales_summary.tail(5)],

['Top 5 Best performing stores', 'Bottom 5 Worst performing stores'],

)

Top 5 Best performing stores

| overall_rank_score | overall_rank | |

|---|---|---|

| store | ||

| 39 | 2 | 1 |

| 4 | 3 | 2 |

| 41 | 4 | 3 |

| 13 | 7 | 4 |

| 17 | 9 | 5 |

Bottom 5 Worst performing stores

| overall_rank_score | overall_rank | |

|---|---|---|

| store | ||

| 27 | 38 | 41 |

| 15 | 39 | 42 |

| 14 | 40 | 43 |

| 35 | 42 | 44 |

| 36 | 42 | 45 |

# Sort stores by average weekly sales descending

sorted_df = store_sales_summary.sort_values(by='overall_rank_score', ascending=True).reset_index()

plt.figure(figsize=(15, 5))

sns.barplot(

data=sorted_df,

x='store',

y='overall_rank_score',

order=sorted_df['store']

)

plt.title('Overall Store-wise Rank Score')

plt.xticks(rotation=90)

plt.tight_layout()

# plt.grid(True)

plt.show()

Conclusions#

By analyzing the composite score rank, stores [39, 4, 41, 13] are the top 5 performers in terms of sales and stores [15, 27, 14, 36, 35] seem to be the worst performers.

Show code cell source

best_stores = ['39', '4', '41', '13', '17']

worst_stores = ['36', '35', '14', '15', '27']

def plot_store_sales(df: pd.DataFrame, store_list: list[str],

title: str) -> None:

num_stores = len(store_list)

fig, axes = plt.subplots(

num_stores,

1,

figsize=(11, 2.5 * num_stores),

sharex=True)

colors = sns.color_palette(

"Set1", num_stores

) # Use a visually appealing color palette

for i, store in enumerate(store_list):

store_data = df[df['store'] == store]

ax = axes[i]

sns.lineplot(

x='date',

y='weekly_sales',

data=store_data,

ax=ax,

label=f'Store {store}',

color=colors[i],

linewidth=1.5) # Adjust line width for better visibility

ax.set_title(f'Weekly Sales - Store {store}', fontsize=12)

ax.set_ylabel('Weekly Sales', fontsize=10)

ax.tick_params(axis='y', labelsize=8)

ax.grid(True, linestyle='--', alpha=0.5) # Add grid for easier reading

# Customize overall plot appearance

fig.suptitle(title, fontsize=16, y=0.95) # Overall title

plt.xlabel('Date', fontsize=10) # Shared x-axis label

plt.tight_layout(

rect=[0, 0.03, 1, 0.92]

) # Adjust layout to prevent overlapping titles

plt.show()

# Plotting for best performing stores

plot_store_sales(df, best_stores, 'Weekly Sales - Best Performing Stores')

# Plotting for worst performing stores

plot_store_sales(df, worst_stores, 'Weekly Sales - Worst Performing Stores')

Checking correlation between unemployment, fuel_price and cpi#

Show code cell source

store = '2'

df_store = df.loc[df['store'] == store].copy()

# Create a scatter plot using Matplotlib

plt.figure(figsize=(11, 4))

# Create a scatter plot

scatter = plt.scatter(df_store['cpi'], df_store['fuel_price'],

c=df_store['unemployment'], cmap='viridis',

edgecolor='w', s=100)

# Add color bar

cbar = plt.colorbar(scatter)

cbar.set_label('Unemployment')

# Add labels and title

plt.title('Scatter Plot of CPI vs Fuel Price with Unemployment for store ' + store)

plt.xlabel('CPI')

plt.ylabel('Fuel Price')

# Adjust layout to avoid overlap

plt.tight_layout()

plt.show()

Show code cell source

# Extract unique stores

stores = sorted(df['store'].unique()) # Sort for consistent order

# Initialize correlation storage

unemployment_cpi = pd.DataFrame(index=['Pearson', 'Spearman', 'Kendall'], columns=stores)

cpi_fuel_price = pd.DataFrame(index=['Pearson', 'Spearman', 'Kendall'], columns=stores)

fuel_price_unemployment = pd.DataFrame(index=['Pearson', 'Spearman', 'Kendall'], columns=stores)

# Compute correlations for each store

for store in stores:

df_store = df[df['store'] == store].sort_values('date').set_index('date')

# Compute correlations (Unemployment vs CPI)

unemployment_cpi.loc['Pearson', store] = df_store['unemployment'].corr(df_store['cpi'], method='pearson')

unemployment_cpi.loc['Spearman', store] = df_store['unemployment'].corr(df_store['cpi'], method='spearman')

unemployment_cpi.loc['Kendall', store] = df_store['unemployment'].corr(df_store['cpi'], method='kendall')

# Compute correlations (CPI vs Fuel Price)

cpi_fuel_price.loc['Pearson', store] = df_store['cpi'].corr(df_store['fuel_price'], method='pearson')

cpi_fuel_price.loc['Spearman', store] = df_store['cpi'].corr(df_store['fuel_price'], method='spearman')

cpi_fuel_price.loc['Kendall', store] = df_store['cpi'].corr(df_store['fuel_price'], method='kendall')

# Compute correlations (Fuel Price vs Unemployment)

fuel_price_unemployment.loc['Pearson', store] = df_store['fuel_price'].corr(df_store['unemployment'], method='pearson')

fuel_price_unemployment.loc['Spearman', store] = df_store['fuel_price'].corr(df_store['unemployment'], method='spearman')

fuel_price_unemployment.loc['Kendall', store] = df_store['fuel_price'].corr(df_store['unemployment'], method='kendall')

# Convert to float type (for better plotting)

unemployment_cpi = unemployment_cpi.astype(float)

cpi_fuel_price = cpi_fuel_price.astype(float)

fuel_price_unemployment = fuel_price_unemployment.astype(float)

# Plot heatmaps

fig, axes = plt.subplots(3, 1, figsize=(22, 9), gridspec_kw={'height_ratios': [1, 1, 1]})

# Unemployment vs cpi Heatmap

sns.heatmap(unemployment_cpi, cmap='coolwarm', annot=True, fmt=".2f", ax=axes[0], vmin=-1, vmax=1)

axes[0].set_title("Correlation: Unemployment vs cpi")

# CPI vs fuel_price Heatmap

sns.heatmap(cpi_fuel_price, cmap='coolwarm', annot=True, fmt=".2f", ax=axes[1], vmin=-1, vmax=1)

axes[1].set_title("Correlation: cpi vs fuel_price")

# Fuel Price vs unemployment Heatmap

sns.heatmap(fuel_price_unemployment, cmap='coolwarm', annot=True, fmt=".2f", ax=axes[2], vmin=-1, vmax=1)

axes[2].set_title("Correlation: fuel_price vs unemployment")

# Adjust layout

plt.tight_layout()

plt.show()

Show code cell source

# Define the extra percentiles you want

extra_percentiles = [0.05, 0.10, 0.15, 0.20, 0.25, 0.75, 0.80, 0.85, 0.90, 0.95]

# Compute the descriptive statistics including the extra percentiles

desc_unemployment_cpi = (

unemployment_cpi.loc["Pearson"]

.describe(percentiles=extra_percentiles)

.reset_index()

.rename(columns={"Pearson": "unemployment vs cpi"})

)

desc_cpi_fuel_price = (

cpi_fuel_price.loc["Pearson"]

.describe(percentiles=extra_percentiles)

.reset_index()

.rename(columns={"Pearson": "cpi vs fuel price"})

)

desc_fuel_price_unemployment = (

fuel_price_unemployment.loc["Pearson"]

.describe(percentiles=extra_percentiles)

.reset_index()

.rename(columns={"Pearson": "fuel price vs unemployment"})

)

# Merge the three DataFrames on the 'index' column

(

desc_unemployment_cpi.merge(desc_cpi_fuel_price, on="index")

.merge(desc_fuel_price_unemployment, on="index")

.set_index("index")

.drop(labels=["count"], axis=0)

)

| unemployment vs cpi | cpi vs fuel price | fuel price vs unemployment | |

|---|---|---|---|

| index | |||

| mean | -0.754107 | 0.814384 | -0.597719 |

| std | 0.374793 | 0.052361 | 0.288258 |

| min | -0.977855 | 0.754134 | -0.873024 |

| 5% | -0.974720 | 0.754206 | -0.851177 |

| 10% | -0.964682 | 0.754895 | -0.839678 |

| 15% | -0.961946 | 0.755325 | -0.833261 |

| 20% | -0.961946 | 0.755369 | -0.795181 |

| 25% | -0.960864 | 0.755861 | -0.787313 |

| 50% | -0.909667 | 0.809476 | -0.679553 |

| 75% | -0.732422 | 0.836295 | -0.538876 |

| 80% | -0.648679 | 0.857948 | -0.485188 |

| 85% | -0.513644 | 0.859545 | -0.479774 |

| 90% | -0.231817 | 0.904258 | -0.384444 |

| 95% | -0.118865 | 0.909358 | 0.066221 |

| max | 0.862500 | 0.910633 | 0.596955 |

Observations#

CPI and Fuel price are strongly positively correlated with each other for ALL stores with average Pearson correlation coefficient of 0.814. This is intuitive because fuel pice is generally considered when calculating CPI.

Unemployment and CPI are negatively correlated for most stores. For 75% of then stores, the correlation is greater in magnitude than 0.73 and for 85% of the stores it’s greater in magnitude than 0.51. But, for the rest of the stores, the correlation gets closer to zero. And for store 24, the correlation is strongly positive with the coefficient being 0.86

Fuel Price and Unemployment are negatively correlated for most stores. This correltion isn’t as strong as Unemployment and CPI. For 75% of then stores, the correlation is greater in magnitude than 0.53. But, for the rest of the stores, the correlation gets closer to zero. And for store 24, the correlation is strongly positive with the coefficient being 0.6

PCA with CPI, Fuel Price, and Unemployment#

Why?#

PCA is used for dimensionality reduction. And while it may seem like we don’t have that high dimensional data with only 5 features, but the fact that we are forecasting the sales store wise makes it so that we have only 143 rows/observations per store with 5 features.

And that’s too little data for us to consider 5 exogenous variables. So we can try to reduce the dimensionality of our data and see if it works.

Show code cell source

# import numpy as np

# import pandas as pd

# import matplotlib.pyplot as plt

from sklearn.decomposition import PCA

from sklearn.preprocessing import StandardScaler

# 1. Group by store

stores = df['store'].unique()

# Let's create a structure to hold the PCA results for each store

store_pca_results = {}

for store_id in stores:

# Filter data for that store

df_store = df[df['store'] == store_id].copy()

# Sort by date to ensure proper time ordering (if not already)

df_store.sort_values(by='date', inplace=True)

# 2. Extract the 3 correlated features

X = df_store[['cpi', 'fuel_price', 'unemployment']].values

# 3. Standardize the features (very important for PCA!)

scaler = StandardScaler()

X_scaled = scaler.fit_transform(X)

# 4. Apply PCA

pca = PCA(n_components=2) # We'll fit up to 3, but we might keep fewer

pca.fit(X_scaled)

# 5. Get the transformed principal components

# shape: (num_weeks, 3)

X_pca = pca.transform(X_scaled)

# 6. Check explained variance

explained_variance = pca.explained_variance_ratio_

# We can store these results

store_pca_results[store_id] = {

'pca_object': pca,

'scaler': scaler,

'explained_variance': explained_variance,

'principal_components': X_pca

}

# OPTIONAL: You can add these principal components back to df_store

# if you want them as features in your next model.

df_store['PC1'] = X_pca[:, 0]

df_store['PC2'] = X_pca[:, 1]

# df_store['PC3'] = X_pca[:, 2]

# Then you might store or export df_store with these new columns

# e.g., store the modified DataFrame in a dictionary or list

store_pca_results[store_id]['df_with_pcs'] = df_store

Show code cell source

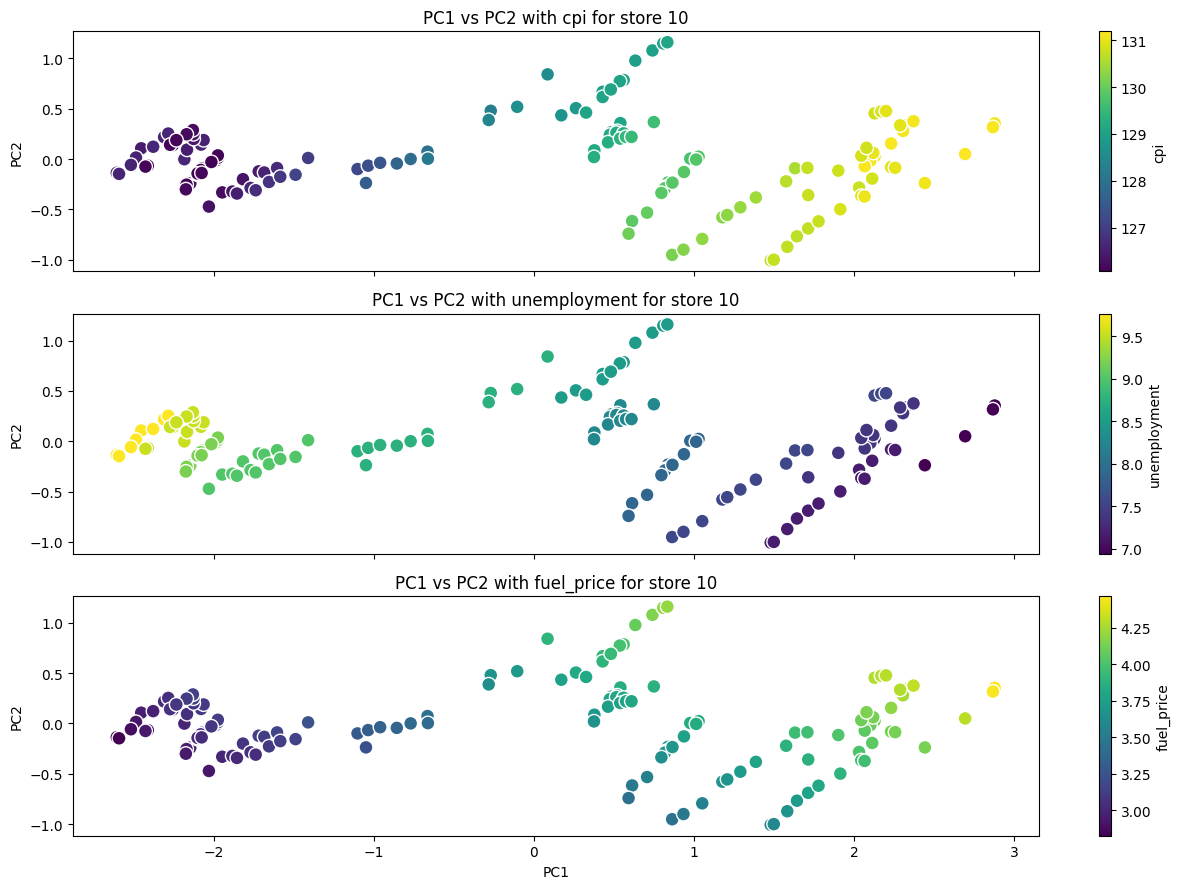

store = "10"

df_store = store_pca_results.get(store).get("df_with_pcs").copy()

# Define the hue variables

hue_variables = ["cpi", "unemployment", "fuel_price"]

# Create subplots

fig, axes = plt.subplots(

len(hue_variables), 1, figsize=(13, 3 * len(hue_variables)), sharex=True, sharey=True

)

# Loop through hue variables and create scatter plots

for i, hue_variable in enumerate(hue_variables):

ax = axes[i] # Get the current subplot

# Create a scatter plot

scatter = ax.scatter(

df_store["PC1"],

df_store["PC2"],

c=df_store[hue_variable],

cmap="viridis",

edgecolor="w",

s=100,

)

# Add color bar

cbar = fig.colorbar(scatter, ax=ax)

cbar.set_label(hue_variable)

# Add labels and title

ax.set_title(f"PC1 vs PC2 with {hue_variable} for store {store}")

ax.set_ylabel("PC2") # Y-axis label for each subplot

# Set common X-axis label for the last subplot

axes[-1].set_xlabel("PC1")

# Adjust layout to avoid overlap

plt.tight_layout()

plt.show()

Show code cell source

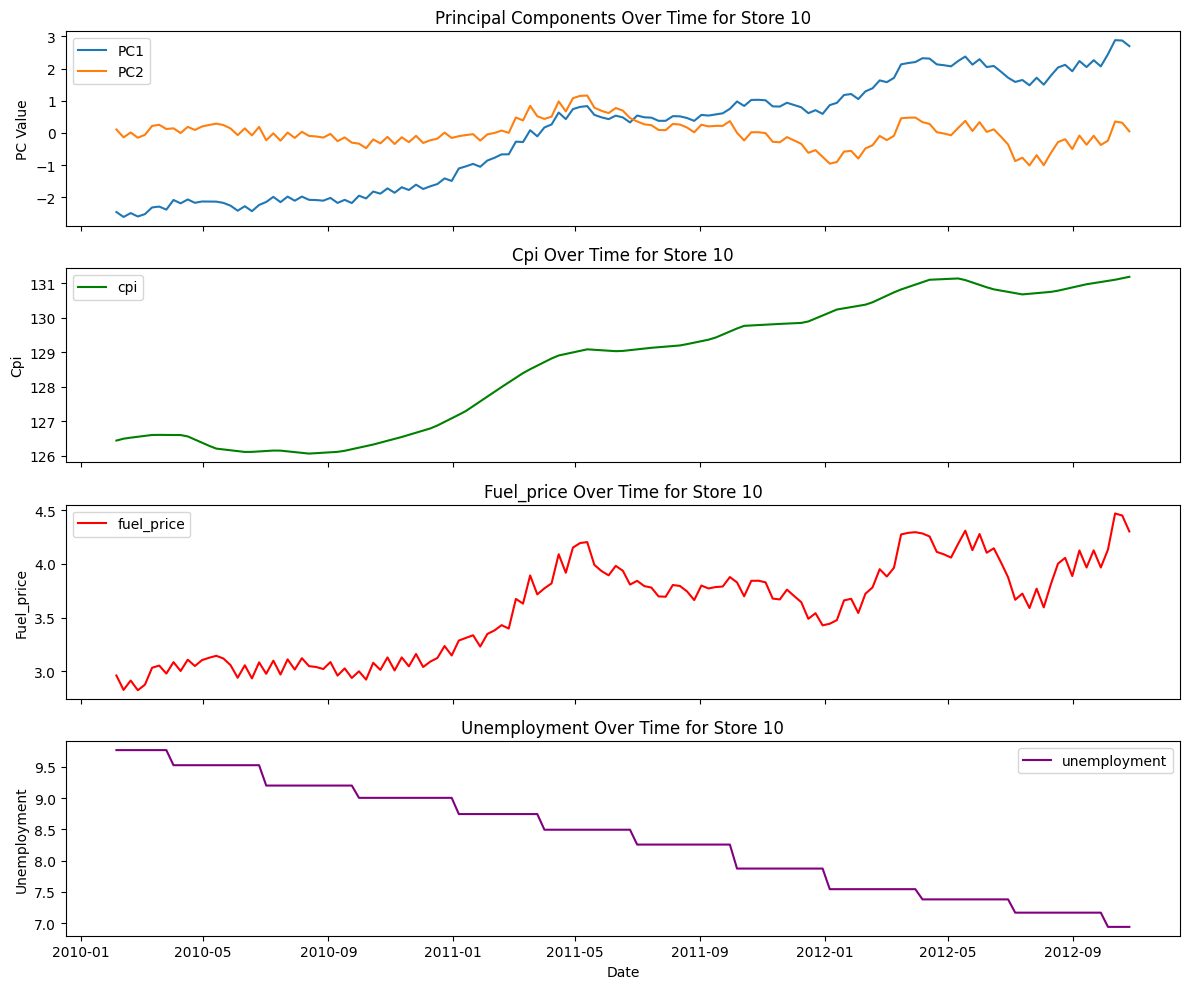

def plot_pcs_time(store_id):

df_store = store_pca_results[store_id]["df_with_pcs"]

metrics = ["cpi", "fuel_price", "unemployment"]

# Create subplots

fig, axes = plt.subplots(len(metrics) + 1, 1, figsize=(12, 2.5 * (len(metrics) + 1)), sharex=True)

# Plot PC1 and PC2

axes[0].plot(df_store["date"], df_store["PC1"], label="PC1")

axes[0].plot(df_store["date"], df_store["PC2"], label="PC2")

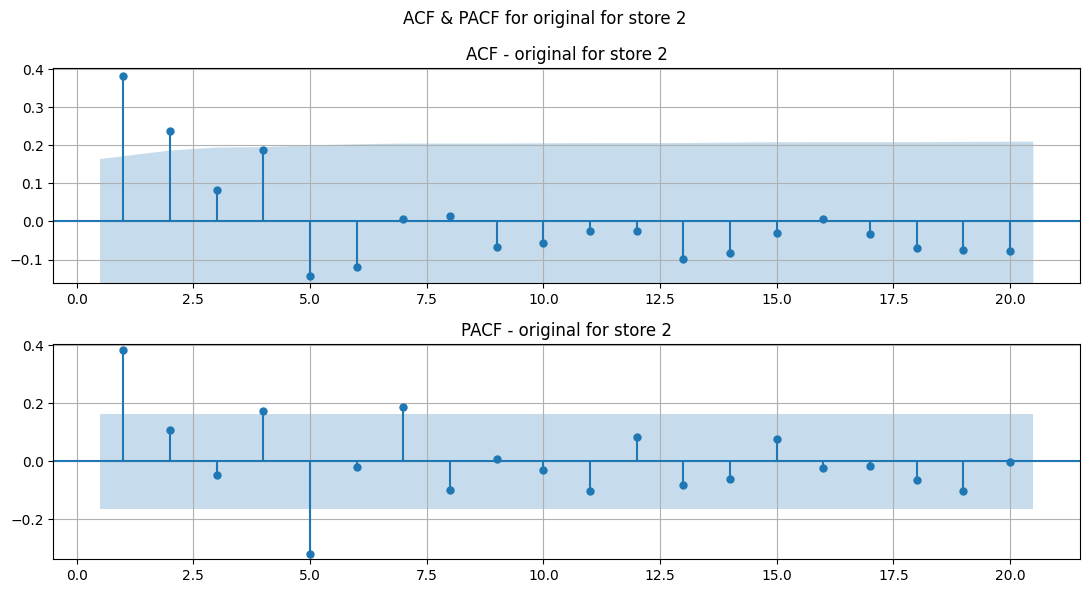

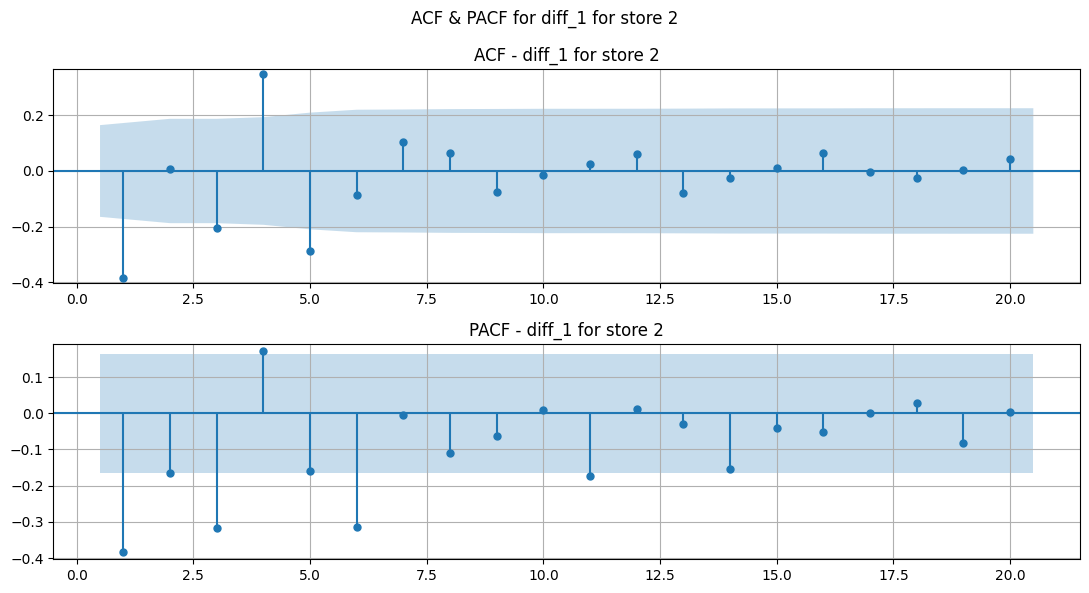

axes[0].set_title(f"Principal Components Over Time for Store {store_id}")

axes[0].set_ylabel("PC Value")

axes[0].legend()

# Plot metrics

colors = ["green", "red", "purple"] # Define colors for each metric

for i, metric in enumerate(metrics):

axes[i + 1].plot(df_store["date"], df_store[metric], label=metric, color=colors[i])

axes[i + 1].set_title(f"{metric.capitalize()} Over Time for Store {store_id}")

axes[i + 1].set_ylabel(metric.capitalize())

axes[i + 1].legend()

# Set x label for the last subplot

axes[-1].set_xlabel("Date")

# Adjust layout and show the plot

plt.tight_layout()

plt.show()

plot_pcs_time("10")

pc1_explained_var = []

pc2_explained_var = []

for key, value in store_pca_results.items():

pc1_explained_var.append(value['explained_variance'][0])

pc2_explained_var.append(value['explained_variance'][1])

explained_var = pd.DataFrame({'PC1': pc1_explained_var, 'PC2': pc2_explained_var})

explained_var['total'] = explained_var['PC1'] + explained_var['PC2']

explained_var.describe()

| PC1 | PC2 | total | |

|---|---|---|---|

| count | 45.000000 | 45.000000 | 45.000000 |

| mean | 0.837000 | 0.142385 | 0.979385 |

| std | 0.087777 | 0.082199 | 0.015858 |

| min | 0.603096 | 0.056002 | 0.933382 |

| 25% | 0.803809 | 0.087022 | 0.972884 |

| 50% | 0.857133 | 0.135813 | 0.983690 |

| 75% | 0.895186 | 0.158574 | 0.990703 |

| max | 0.934701 | 0.365466 | 0.994236 |

Conclusion/Observations#

The 3 features cpi, unemployment and fuel_price are reduced to 2 principal components which on average (across all stores) explains 97% variance across the 3 features.

The minimum of this total explained various only drops to 93% across all stores. Which is pretty good.

When I tried reducing the features to just 1 principal component, I got worse results where on average (across all stores) the variance explained was only 83%

Stationarity#

ADF test

KPSS test

Transformations#

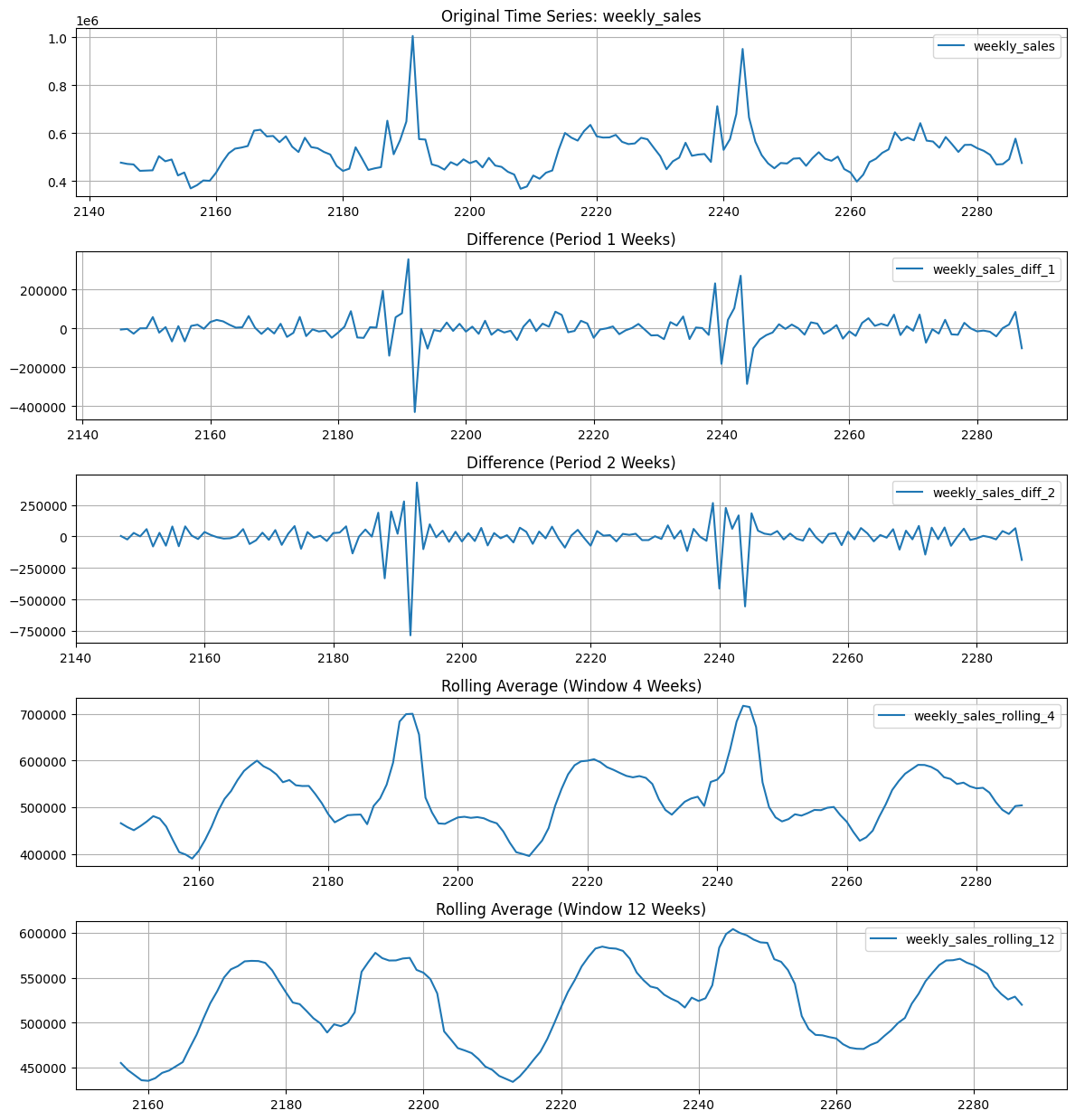

Show code cell source

store = '16'

df_store = df.loc[df['store'] == store].copy()

time_series_col = 'weekly_sales'

periods_diff = [1, 2] # Number of times for differencing

window_sizes = [4, 12] # Number of weeks for rolling averages

# Create difference transformations

df_store[f"{time_series_col}_diff_1"] = df_store[time_series_col].diff(periods=1).copy()

df_store[f"{time_series_col}_diff_2"] = df_store[f"{time_series_col}_diff_1"].diff(periods=1).copy()

# Create rolling average transformations

for window in window_sizes:

df_store[f"{time_series_col}_rolling_{window}"] = (

df_store[time_series_col].rolling(window=window).mean()

).copy()

# Plotting

num_plots = 1 + len(periods_diff) + len(window_sizes)

fig, axes = plt.subplots(num_plots, 1, figsize=(12, 2.5 * num_plots)) # Adjusted figsize

# Plot original time series

axes[0].plot(df_store.index, df_store[time_series_col], label=time_series_col)

axes[0].set_title(f"Original Time Series: {time_series_col}")

axes[0].legend()

axes[0].grid(True)

# Plot difference transformations

for i, period in enumerate(periods_diff):

col_name = f"{time_series_col}_diff_{period}"

axes[i + 1].plot(df_store.index, df_store[col_name], label=col_name)

axes[i + 1].set_title(f"Difference (Period {period} Weeks)")

axes[i + 1].legend()

axes[i + 1].grid(True)

# Plot rolling average transformations

for i, window in enumerate(window_sizes):

col_name = f"{time_series_col}_rolling_{window}"

axes[len(periods_diff) + i + 1].plot(

df_store.index, df_store[col_name], label=col_name

)

axes[len(periods_diff) + i + 1].set_title(

f"Rolling Average (Window {window} Weeks)"

)

axes[len(periods_diff) + i + 1].legend()

axes[len(periods_diff) + i + 1].grid(True)

plt.tight_layout()

plt.show()

Observations#

From manual inspection atleast, 1st and 2nd differencing make the series mostly stationary. However, the holiday effect is still present.

Rolling averages are not helping much.

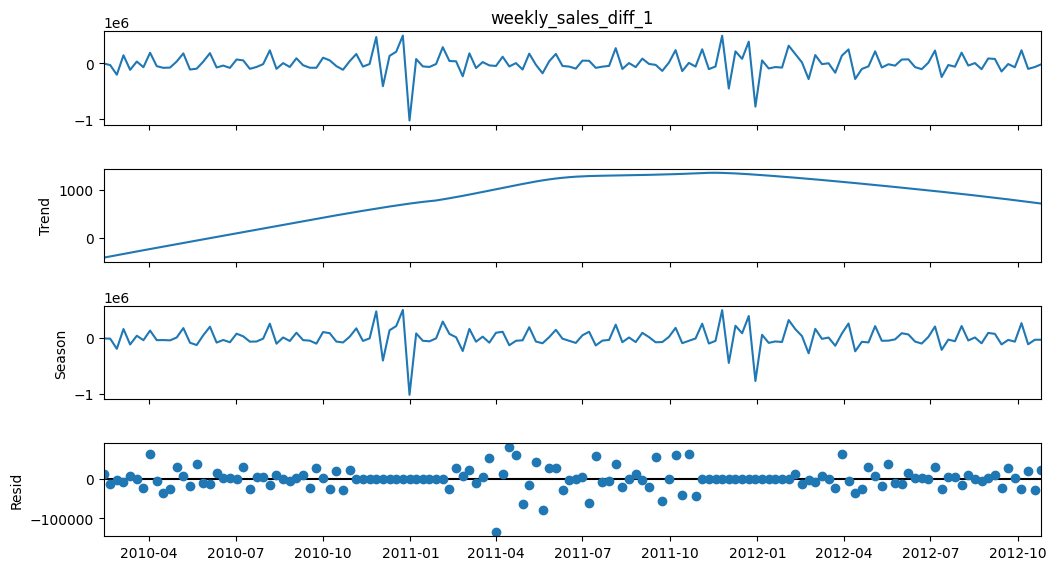

Seasonal Decomposition of Differences#

Show code cell source

store = '1'

df_store = df.loc[df['store'] == store].copy()

df_store.set_index('date', inplace=True)

time_series_col = 'weekly_sales'

periods_diff = [1, 2] # Number of weeks for differencing

window_sizes = [2, 4, 6] # Number of weeks for rolling averages

# Create difference transformations

df_store[f"{time_series_col}_diff_1"] = df_store[time_series_col].diff(periods=1).copy()

df_store[f"{time_series_col}_diff_2"] = df_store[f"{time_series_col}_diff_1"].diff(periods=1).copy()

# Create rolling average transformations

for window in window_sizes:

df_store[f"{time_series_col}_rolling_{window}"] = (

df_store[time_series_col].rolling(window=window).mean()

).copy()

y = df_store[f"{time_series_col}_diff_1"].dropna()

# We assume an annual (52-week) seasonal period

stl = STL(y, period = 52, robust=False)

result = stl.fit()

fig = result.plot()

fig.set_size_inches(12, 6)

mstl = MSTL(y, periods=[4, 52], iterate=5)

result = mstl.fit()

fig = result.plot()

fig.set_size_inches(12, 6)

plt.show()

Observations#

STL decomposition of diff 1 shows good results. It may look like there’s a trend, but comparing it’s range to the range of sales diff 1, it is insignificant.

MSTL would have been promising for seasonal periods of 5 (1 month) and 52 weeks (1 year). But, since our years are not fully divisible into whole weeks, it is difficult to capture seasonality. Same for monthly seasonality.

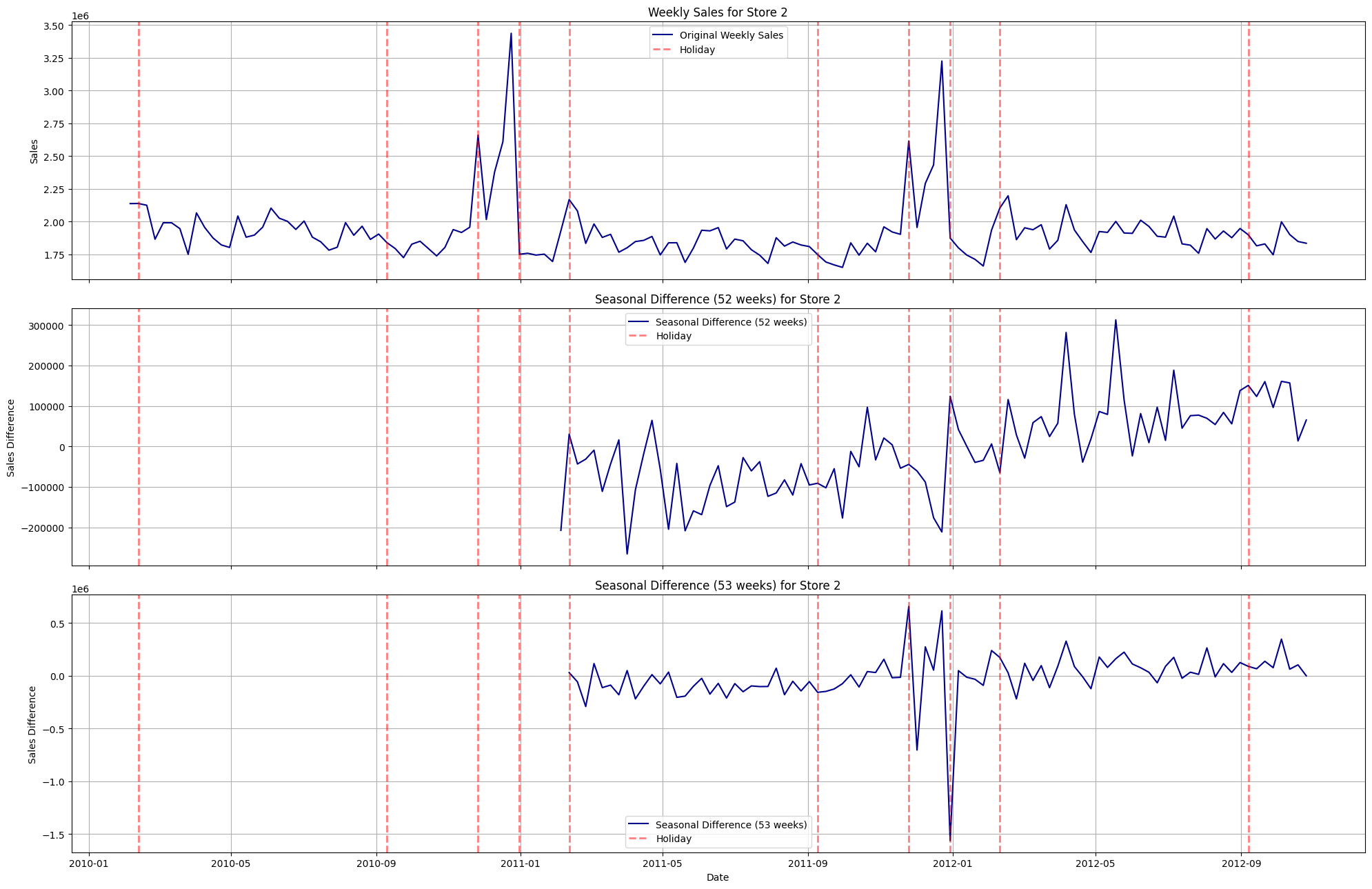

Seasonal Differencing#

Show code cell source

store_number = "2"

store_df = df[df["store"] == store_number].copy()

store_df = store_df.sort_values(by="date")

store_df["seasonal_diff_52"] = store_df["weekly_sales"].diff(periods=52)

store_df["seasonal_diff_53"] = store_df["weekly_sales"].diff(periods=53)

# Define dark blue color

dark_blue = "#00008B"

# Create subplots

fig, axes = plt.subplots(3, 1, figsize=(20, 13), sharex=True)

# Function to add holiday annotations

def add_holiday_annotations(ax, df):

holiday_dates = df.loc[df["holiday_flag"], 'date']

for date in holiday_dates:

ax.axvline(

x=date, color="red", linestyle="--", alpha=0.5, label="Holiday" if date == holiday_dates.iloc[0] else None,

linewidth=2,

)

# Plot original weekly sales

sns.lineplot(

x="date",

y="weekly_sales",

data=store_df,

ax=axes[0],

label="Original Weekly Sales",

color=dark_blue,

)

add_holiday_annotations(axes[0], store_df)

axes[0].set_title(f"Weekly Sales for Store {store_number}")

axes[0].set_ylabel("Sales")

axes[0].grid(True)

axes[0].legend()

# Plot seasonal difference (52 weeks)

sns.lineplot(

x="date",

y="seasonal_diff_52",

data=store_df,

ax=axes[1],

label="Seasonal Difference (52 weeks)",

color=dark_blue,

)

add_holiday_annotations(axes[1], store_df)

axes[1].set_title(f"Seasonal Difference (52 weeks) for Store {store_number}")

axes[1].set_ylabel("Sales Difference")

axes[1].grid(True)

axes[1].legend()

# Plot seasonal difference (53 weeks)

sns.lineplot(

x="date",

y="seasonal_diff_53",

data=store_df,

ax=axes[2],

label="Seasonal Difference (53 weeks)",

color=dark_blue,

)

add_holiday_annotations(axes[2], store_df)

axes[2].set_title(f"Seasonal Difference (53 weeks) for Store {store_number}")

axes[2].set_xlabel("Date")

axes[2].set_ylabel("Sales Difference")

axes[2].grid(True)

axes[2].legend()

plt.tight_layout() # Adjust layout to prevent labels from overlapping

plt.show()

Observations#

Holidays in this case repeat every 365 days (a year). But, unfortunately, we have weekly data and can only use 52 or 53 weeks for differencing instead of something like 52.5 days which would be 1 proper year.

That’s why, we can observe few peculiarities: for some holidays, the 52 week differencing nullifies the holiday effect boost (excluding the general updards trend ofcourse) and for the rest, it doesn’t nullify the effect due to reasons mentioned in previous point.

Same for 53 weeks differencing. For some holidays, it nullifies the holiday effect boost and for the rest, it doesn’t.

ADF and KPSS test for stationarity#

Show code cell source

from statsmodels.tsa.stattools import adfuller, kpss

# Define helper functions for ADF and KPSS tests

def run_adf(series):

result = adfuller(series, autolag='AIC')

return {

"adf_stat": result[0],

"p_value": result[1],

"n_lags": result[2],

"n_obs": result[3],

"crit_1%": result[4].get("1%"),

"crit_5%": result[4].get("5%"),

"crit_10%": result[4].get("10%"),

"ic_best": result[5] # information criterion used for lag selection

}

def run_kpss(series, regression="c"):

result = kpss(series, regression=regression, nlags="auto")

return {

"kpss_stat": result[0],

"p_value": result[1],

"n_lags": result[2],

"crit_10%": result[3].get("10%"),

"crit_5%": result[3].get("5%"),

"crit_2.5%": result[3].get("2.5%"),

"crit_1%": result[3].get("1%")

}

# Containers for storing results for each test and differencing order

adf_diff1_results = []

adf_diff2_results = []

kpss_diff1_results = []

kpss_diff2_results = []

for store in df["store"].cat.categories:

# Subset data for the store and sort by date

store_data = df[df["store"] == store].sort_values("date")

sales_series = store_data["weekly_sales"]

# Compute first and second differences (drop the NaN at the beginning)

diff1 = sales_series.diff(1).dropna()

diff2 = sales_series.diff(2).dropna()

# Run tests and capture the results.

# Using try/except to catch any errors (e.g., if the series is too short)

with warnings.catch_warnings():

warnings.filterwarnings("ignore")

adf_res1 = run_adf(diff1)

adf_res2 = run_adf(diff2)

kpss_res1 = run_kpss(diff1, regression="c")

kpss_res2 = run_kpss(diff2, regression="c")

# Add a reference to the store (to facilitate grouping later)

adf_res1["store"] = store

adf_res2["store"] = store

kpss_res1["store"] = store

kpss_res2["store"] = store

adf_diff1_results.append(adf_res1)

adf_diff2_results.append(adf_res2)

kpss_diff1_results.append(kpss_res1)

kpss_diff2_results.append(kpss_res2)

# Create DataFrames (using store as index)

adf_diff1_df = pd.DataFrame(adf_diff1_results).set_index("store")

adf_diff2_df = pd.DataFrame(adf_diff2_results).set_index("store")

kpss_diff1_df = pd.DataFrame(kpss_diff1_results).set_index("store")

kpss_diff2_df = pd.DataFrame(kpss_diff2_results).set_index("store")

# Get descriptive summaries for each test and differencing order.

# The describe() output uses as index: count, mean, std, min, 25%, 50%, 75%, max.

adf_diff1_summary = adf_diff1_df.describe()

adf_diff2_summary = adf_diff2_df.describe()

kpss_diff1_summary = kpss_diff1_df.describe()

kpss_diff2_summary = kpss_diff2_df.describe()

ADF for 1st order differences#

adf_diff1_summary

| adf_stat | p_value | n_lags | n_obs | crit_1% | crit_5% | crit_10% | ic_best | |

|---|---|---|---|---|---|---|---|---|

| count | 45.000000 | 45.000000 | 45.000000 | 45.000000 | 45.000000 | 45.000000 | 45.000000 | 45.000000 |

| mean | -6.888685 | 0.000164 | 6.733333 | 134.266667 | -3.480035 | -2.883326 | -2.578388 | 3278.859720 |

| std | 1.601953 | 0.000525 | 2.480836 | 2.480836 | 0.000956 | 0.000416 | 0.000222 | 231.917915 |

| min | -13.345453 | 0.000000 | 2.000000 | 127.000000 | -3.482920 | -2.884580 | -2.579058 | 2725.440942 |

| 25% | -7.487731 | 0.000000 | 5.000000 | 134.000000 | -3.480119 | -2.883362 | -2.578407 | 3208.775174 |

| 50% | -7.053856 | 0.000000 | 7.000000 | 134.000000 | -3.480119 | -2.883362 | -2.578407 | 3339.947073 |

| 75% | -6.567946 | 0.000000 | 7.000000 | 136.000000 | -3.479372 | -2.883037 | -2.578234 | 3428.869715 |

| max | -3.812654 | 0.002780 | 14.000000 | 139.000000 | -3.478294 | -2.882568 | -2.577983 | 3544.995400 |

Observations#

Maximum p-value for the storewise sales is < 0.0027 which is obviously very low than the 0.05 threshold.

The max ADF statistic value is lower than the minimum value of 5% critical value. That implies, for ALL stores, the ADF test statistic is less than 5% critical value.

Hence, for 1st order differencing, we can confidently reject the null hypothesis that the series is non-stationary for all stores.

ADF for 2nd order differences#

adf_diff2_summary

| adf_stat | p_value | n_lags | n_obs | crit_1% | crit_5% | crit_10% | ic_best | |

|---|---|---|---|---|---|---|---|---|

| count | 45.000000 | 45.000000 | 45.000000 | 45.000000 | 45.000000 | 45.000000 | 45.000000 | 45.000000 |

| mean | -5.915064 | 0.006170 | 8.022222 | 131.977778 | -3.480935 | -2.883717 | -2.578597 | 3262.797691 |

| std | 1.421504 | 0.025940 | 3.602328 | 3.602328 | 0.001408 | 0.000612 | 0.000327 | 228.548549 |

| min | -8.678118 | 0.000000 | 2.000000 | 126.000000 | -3.483346 | -2.884766 | -2.579156 | 2720.287960 |

| 25% | -7.143230 | 0.000000 | 5.000000 | 129.000000 | -3.482088 | -2.884219 | -2.578864 | 3192.138229 |

| 50% | -5.806791 | 0.000000 | 9.000000 | 131.000000 | -3.481282 | -2.883868 | -2.578677 | 3324.474716 |

| 75% | -5.132804 | 0.000012 | 11.000000 | 135.000000 | -3.479743 | -2.883198 | -2.578320 | 3412.071615 |

| max | -2.333016 | 0.161541 | 14.000000 | 138.000000 | -3.478648 | -2.882722 | -2.578065 | 3525.435008 |

adf_diff2_df.loc[adf_diff2_df['p_value'] > 0.05]

| adf_stat | p_value | n_lags | n_obs | crit_1% | crit_5% | crit_10% | ic_best | |

|---|---|---|---|---|---|---|---|---|

| store | ||||||||

| 33 | -2.816371 | 0.055973 | 13 | 127 | -3.482920 | -2.884580 | -2.579058 | 2720.287960 |

| 38 | -2.333016 | 0.161541 | 14 | 126 | -3.483346 | -2.884766 | -2.579156 | 2848.628100 |

adf_diff2_df.loc[adf_diff2_df['adf_stat'] > adf_diff2_df['crit_5%']]

| adf_stat | p_value | n_lags | n_obs | crit_1% | crit_5% | crit_10% | ic_best | |

|---|---|---|---|---|---|---|---|---|

| store | ||||||||

| 33 | -2.816371 | 0.055973 | 13 | 127 | -3.482920 | -2.884580 | -2.579058 | 2720.287960 |

| 38 | -2.333016 | 0.161541 | 14 | 126 | -3.483346 | -2.884766 | -2.579156 | 2848.628100 |

Observations#

Except for stores 33 and 38, all stores have p-value less than 0.05 threshold.

Similary, except for stores 33 and 38, all stores have ADF statistic value less than 5% critical value.

These stores are an exception as they don’t follow the general trends and seasonality found in other stores

So, for rest of the stores, we can confidently reject the null hypothesis and conclude that the storewise sales are stationary.

KPSS test for 1st difference#

kpss_diff1_summary

| kpss_stat | p_value | n_lags | crit_10% | crit_5% | crit_2.5% | crit_1% | |

|---|---|---|---|---|---|---|---|

| count | 45.000000 | 45.000000 | 45.000000 | 45.000000 | 45.000000 | 45.000000 | 45.000000 |

| mean | 0.149684 | 0.098210 | 37.577778 | 0.347000 | 0.463000 | 0.574000 | 0.739000 |

| std | 0.082114 | 0.009235 | 23.288203 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| min | 0.057553 | 0.041667 | 15.000000 | 0.347000 | 0.463000 | 0.574000 | 0.739000 |

| 25% | 0.105590 | 0.100000 | 25.000000 | 0.347000 | 0.463000 | 0.574000 | 0.739000 |

| 50% | 0.130501 | 0.100000 | 31.000000 | 0.347000 | 0.463000 | 0.574000 | 0.739000 |

| 75% | 0.155536 | 0.100000 | 43.000000 | 0.347000 | 0.463000 | 0.574000 | 0.739000 |

| max | 0.500000 | 0.100000 | 141.000000 | 0.347000 | 0.463000 | 0.574000 | 0.739000 |

kpss_diff1_df.loc[kpss_diff1_df['p_value'] < 0.05]

| kpss_stat | p_value | n_lags | crit_10% | crit_5% | crit_2.5% | crit_1% | |

|---|---|---|---|---|---|---|---|

| store | |||||||

| 16 | 0.500000 | 0.041667 | 141 | 0.347000 | 0.463000 | 0.574000 | 0.739000 |

kpss_diff1_df.loc[kpss_diff1_df['kpss_stat'] > kpss_diff1_df['crit_5%']]

| kpss_stat | p_value | n_lags | crit_10% | crit_5% | crit_2.5% | crit_1% | |

|---|---|---|---|---|---|---|---|

| store | |||||||

| 16 | 0.500000 | 0.041667 | 141 | 0.347000 | 0.463000 | 0.574000 | 0.739000 |

Observations#

Unlike convention, for KPSS test, failure to reject null hypothesis implies that the series is stationary.

Except for store 16, all stores have p-value more than 0.05 threshold.

Similary, except for store16, all stores have ADF statistic value more than 5% critical value.

This store is an exception as it doesn’t follow the general trends and seasonality found in other stores

So, for rest of the stores, we can don’t have enough evidence to reject the null hypothesis and conclude that the storewise sales are stationary.

KPSS test for 2nd difference#

kpss_diff2_summary